Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Are you searching for a reliable company to assist with managing your retirement funds and investments? The Entrust Group could be the solution you’re looking for.

In this detailed review, we’ll take an in-depth look at what The Entrust Group offers, including their range of services, associated fees, the process of opening an account, the advantages and disadvantages of using their services, customer reviews, and help you determine whether The Entrust Group is the right choice for your financial future.

Let’s dive in!

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Click Here to Read Our Top 5 Gold Companies List

Hand picked top 5 trusted and best reviewed companies

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW __CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“90958”:{“name”:”Main Accent Light”,”parent”:”98bf6″,”lock”:{“lightness”:1}},”98bf6″:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default”,”value”:{“colors”:{“90958”:{“val”:”rgb(229, 235, 230)”,”hsl_parent_dependency”:{“h”:129,”l”:0.91,”s”:0.12}},”98bf6″:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431,”a”:1}}},”gradients”:[]},”original”:{“colors”:{“90958”:{“val”:”rgb(223, 245, 238)”,”hsl_parent_dependency”:{“h”:160,”s”:0.52,”l”:0.91,”a”:1}},”98bf6″:{“val”:”rgb(1, 170, 119)”,”hsl”:{“h”:161,”s”:0.98,”l”:0.33,”a”:1}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Table of Contents Heading 2 ExampleHeading 3 ExampleHeading 4 ExampleHeading 2 ExampleHeading 3 ExampleHeading 4 Example

Key Takeaways

- The Entrust Group offers a wide range of self-directed IRA and retirement plan services for individuals and small businesses.

- Opening an account with The Entrust Group is a simple and straightforward process.

- Customers have mixed reviews about The Entrust Group, with some praising their services and others expressing dissatisfaction with fees and customer service.

What is The Entrust Group?

The Entrust Group is a financial services company headquartered in California, specializing in self-directed IRA services and managing over $4 billion in retirement assets.

![]()

Founded by Eric Rosenberg, a financial expert with degrees from the University of Colorado and the University of Denver, the company aims to give the power to individuals in their retirement planning by offering a diverse range of investment options.

With a rich history dating back to 1981, Entrust Group has steadily grown into a leading player in the retirement asset management field. Eric Rosenberg’s vision of providing clients with self-directed IRAs has been pivotal in shaping the company’s trajectory.

Over the years, Entrust Group has seen significant milestones, including successfully guiding clients through market fluctuations and economic downturns. Notable figures like Karen Augustine, who serves as the company’s Chief Operating Officer, have played a crucial role in ensuring the company’s success.

What Services Does The Entrust Group Offer?

The Entrust Group offers a comprehensive range of services designed to help individuals manage their retirement and investment accounts more effectively. Their offerings include self-directed IRA services, Solo 401(k) plans, Health Savings Accounts (HSA), Coverdell Education Savings Accounts (ESA), and more, allowing for diversified investment in assets such as real estate and precious metals.

Self-Directed IRA Services

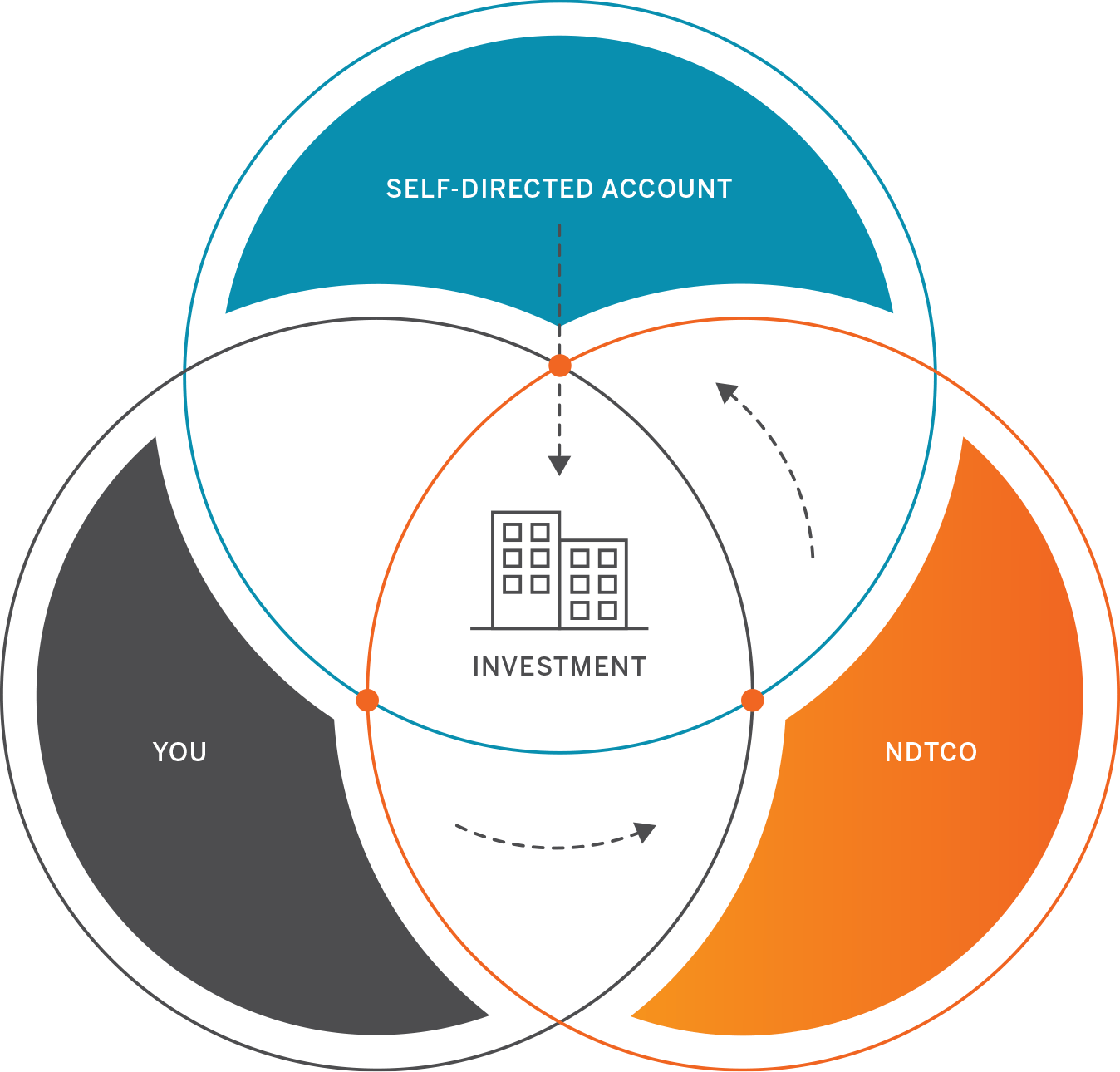

The Entrust Group specializes in self-directed IRA services, enabling investors to diversify their retirement portfolios by including alternative assets such as real estate, precious metals, and even cryptocurrency.

One of the key advantages of self-directed IRAs is the ability to invest in a wide array of assets beyond traditional stocks and bonds. Investors can choose to allocate their funds towards private equity, tax liens, loans, and even startup businesses.

This flexibility allows investors to tailor their portfolios according to their risk tolerance and investment goals, providing a level of control not typically found in conventional retirement accounts.

Solo 401(k) Services

The Solo 401(k) services offered by the Entrust Group are tailored for self-employed individuals and small business owners, providing a robust retirement solution that adheres to IRS regulations.

One of the standout benefits of a Solo 401(k) plan is the higher contribution limits it offers compared to other retirement options. This allows individuals to save more for their retirement while also benefiting from potential tax advantages.

Solo 401(k) plans come with loan provisions, allowing participants to borrow against their retirement savings in times of need without penalty. These features make Solo 401(k) plans a versatile and appealing choice for those looking to secure their financial future as self-employed professionals or small business owners.

Health Savings Account (HSA) Services

Health Savings Account (HSA) services from the Entrust Group provide individuals with a tax-advantaged way to save for healthcare expenses, making it easier to manage medical costs while saving for retirement.

One of the key benefits of an HSA is the triple tax advantage it offers. Contributions are tax-deductible, the funds in the account grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This trifecta of tax benefits can lead to significant savings over time.

HSAs provide individuals with flexibility in how they use the funds. Unlike FSAs, the money in an HSA rolls over year after year, allowing individuals to build a sizable nest egg for medical expenses in retirement.

Education Savings Account (ESA) Services

The Entrust Group’s Coverdell Education Savings Account (ESA) services provide families with the opportunity to save for education expenses with the benefit of tax-free growth.

These ESAs offer a range of advantages to families looking to secure a brighter future for their children. Eligibility criteria are quite broad, allowing most families to open an ESA for their child without income restrictions.

The contribution limits are generous, currently set at $2,000 per child per year. This enables families to accumulate significant savings over time, especially considering the tax advantages associated with ESAs. Funds invested in ESAs can grow tax-free, ensuring that every dollar saved goes towards the child’s education.

The long-term savings potential of ESAs is particularly appealing, as these accounts can be used for a variety of educational expenses, including tuition, books, and even certain housing costs.

Health Reimbursement Arrangement (HRA) Services

Health Reimbursement Arrangements (HRA) offered by the Entrust Group are employer-funded plans that reimburse employees for qualified medical expenses, providing a flexible and tax-efficient way to manage healthcare costs.

For employers, HRAs offer a cost-effective solution to provide benefits to their employees without the administrative burden of traditional health insurance plans. They can customize the HRA to suit their budget and the needs of their workforce, making it a versatile tool for employee retention and recruitment.

Employees benefit from HRAs as they can use the funds allocated to cover a wide range of medical expenses such as doctor’s visits, prescription medications, and even certain over-the-counter items, giving them more control over their healthcare spending.

Retirement Plan Services for Small Businesses

The Entrust Group offers tailored retirement plan services for small businesses, including customized 401(k) plans that help business owners and their employees invest in a secure financial future.

In terms of retirement planning for small businesses, it’s essential to explore the various options available. Alongside traditional 401(k) plans, SIMPLE IRAs, and SEP IRAs are popular choices. These plans offer tax advantages and incentives for both employers and employees.

By providing retirement benefits, businesses can attract and retain top talent, boosting employee morale and loyalty. The Entrust Group is dedicated to assisting businesses in navigating the complexities of setting up and managing these retirement plans efficiently.

What Are The Fees and Costs Associated with The Entrust Group?

The fees and costs associated with The Entrust Group vary depending on the type of account and transactions involved, with charges typically encompassing account setup, annual maintenance, and specific transaction fees.

For instance, the setup fees cover the necessary administrative processes to establish your account, ranging from documentation verification to account activation. These fees ensure that your account is properly set up and compliant with regulatory requirements.

Moving on to annual maintenance fees, these are charged to cover the ongoing management and support for your account throughout the year. It includes services such as account reviews, customer support, and ensuring overall account health and functionality.

Specific transaction fees apply to each individual transaction, such as purchases, sales, or transfers, and are usually a set amount or percentage of the transaction value.

How Do You Open an Account with The Entrust Group?

Opening an account with The Entrust Group is a straightforward process that can be completed through their online portal, with customer support available to assist at every step.

Upon visiting The Entrust Group’s website, you can easily navigate to the account opening section. Here, you will be prompted to select the type of account you wish to open, ranging from Traditional IRA to Self-Directed Solo 401(k). Next, you will need to fill in your personal details, such as name, contact information, and social security number.

During the setup process, ensure you have necessary documentation ready, including a valid ID and proof of address. Should you encounter any challenges, don’t hesitate to reach out to the dedicated customer support team via phone or email for assistance.

After submitting your information, you may be required to verify your identity for security purposes. Once your account is validated, you will gain access to a range of investment options and resources to start growing your wealth.

What Are The Pros of Using The Entrust Group?

The pros of using The Entrust Group include exceptional customer service, access to diversified investment options like real estate investing, and advanced technology with robust cybersecurity measures.

One of the key benefits of choosing The Entrust Group is their unwavering commitment to providing top-notch customer service. Clients can rest assured that their inquiries will be promptly addressed and that they will receive the support and guidance they need throughout their investment journey.

The Entrust Group offers a wide range of investment options, allowing clients to diversify their portfolios and explore opportunities in various sectors, including real estate. The Entrust Group leverages cutting-edge technology and implements stringent cybersecurity measures to safeguard clients’ information and assets.

By prioritizing data security, they ensure that clients can invest with peace of mind, knowing that their sensitive data is protected from potential threats. This dedication to utilizing advanced technology sets The Entrust Group apart in the realm of financial services, providing clients with a secure and efficient investment experience.

What Are The Cons of Using The Entrust Group?

While the Entrust Group offers numerous benefits, some potential cons include higher fees compared to other providers and mixed reviews about customer support in online publications.

Customers have expressed concerns about the transparency of fee structures, with some feeling that they are not clearly outlined. There have been reports of delayed response times and difficulty reaching knowledgeable customer support representatives when assistance is needed.

Several online reviews mention frustration with hidden charges and unexpected costs, leading to a sense of unpredictability in overall expenses. This lack of clarity can be particularly challenging for individuals looking to maximize their investments while minimizing unnecessary expenditures.

What Do Customers Say About The Entrust Group?

Customer reviews of The Entrust Group are generally positive, with many praising the company’s customer service, though some reviews on platforms like the BBB highlight areas for improvement.

Positive Reviews

The Entrust Group often commend the company’s outstanding customer service, diverse investment options, and straightforward account setup process.

Customers frequently mention how The Entrust Group goes above and beyond to answer their questions and provide guidance throughout the investment process. One reviewer mentioned, ‘Their customer service is top-notch – always responsive and helpful.

‘Investors appreciate the wide range of investment opportunities available, with one client stating, ‘I love the diverse options that The Entrust Group offers, allowing me to tailor my portfolio to my preferences.’ Another standout feature is the simplicity of setting up an account, which a satisfied customer described as ‘the easiest process I’ve ever experienced in opening an investment account.’

Negative Reviews

The Entrust Group typically focus on the higher fees and occasional issues with customer support and transaction processing times.

Customers have expressed frustration over what they perceive as unwarranted fees that eat into their investment returns. Some reviewers have pointed out that while the initial fees may seem reasonable, the cumulative costs over time add up significantly.

Complaints about customer support center around delays in response times and ineffective resolutions to queries or concerns. For instance, one review mentioned feeling left in the dark for weeks without updates on a pending transaction.

In terms of transaction processing times, customers have highlighted instances where delays impacted their ability to execute timely investments or transfers, leading to missed opportunities or monetary losses.

Is The Entrust Group Legit and Safe to Use?

The Entrust Group is a legitimate and safe option for managing self-directed IRAs and other retirement accounts, with robust cybersecurity measures in place to protect client information and assets.

Established in 1981, The Entrust Group has built a strong reputation over the years for their reliable services in the realm of self-directed IRAs.

Eric Rosenberg, an esteemed financial writer, has often highlighted the company’s commitment to client security. With an emphasis on transparency and compliance, Entrust ensures that all transactions are conducted with the highest level of integrity.

- Entrust not only prioritizes safeguarding client data through encryption and monitoring but also regularly updates their security protocols to stay ahead of potential threats in the digital landscape.

Entrust’s dedication to maintaining the utmost security standards underscores their credibility as a trusted partner for individuals seeking to navigate the complexities of self-directed retirement accounts.

Frequently Asked Questions

1. What is The Entrust Group Review?

The Entrust Group Review refers to the process of evaluating and sharing feedback about the services and products offered by The Entrust Group, a leading provider of self-directed IRA and 401(k) plans.

2. How do I leave a review for The Entrust Group?

To leave a review for The Entrust Group, you can visit their website and click on the “Leave a Review” button on the homepage. You can also leave a review on third-party review sites such as Google or Yelp.

3. What should I include in my review of The Entrust Group?

You should include your overall experience with The Entrust Group, the level of customer service you received, the quality of products and services, and any specific details of your experience that you want to share.

4. Are reviews for The Entrust Group reliable?

Yes, reviews for The Entrust Group are reliable as they are written by real customers who have used their services and products. The company also has a strict review policy to ensure authenticity and transparency.

5. Can I read reviews for The Entrust Group on their website?

Yes, The Entrust Group has a dedicated section on their website where customers can read reviews and ratings from other clients. These reviews are regularly updated to provide the most recent and accurate feedback.

6. How does The Entrust Group handle negative reviews?

The Entrust Group takes all reviews seriously, whether positive or negative. The company has a team dedicated to addressing and resolving any issues or concerns raised in negative reviews to ensure customer satisfaction.

Final Verdict

Conclusion: Is The Entrust Group Worth Considering?

The Entrust Group offers a comprehensive and flexible approach to managing retirement and investment accounts, making it a worthwhile consideration for those looking to diversify their portfolios despite the higher fees.

One of the key advantages of choosing The Entrust Group is the wide range of investment options available, allowing individuals to tailor their accounts to their specific financial goals. The company’s reputation for exceptional customer service and expertise in self-directed IRAs adds to its appeal.

On the downside, some may find the higher fees associated with The Entrust Group off-putting, especially compared to other retirement account management services. The complexity of self-directed IRAs may not be suitable for all investors, requiring a certain level of knowledge and active involvement.

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

Remember to read our list of the Top Gold Companies to see if The Entrust Group made the cut.

>> Click HERE to read our 5 Best Gold IRA Companies list <<

Or, if you like what you read about The Entrust Group, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.