Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Rosland Capital is a renowned company in the gold investment industry, known for its exceptional services and offerings.

In this comprehensive review, we will delve into the background of Rosland Capital, examine customer reviews and recommendations, explore their gold IRA products and pricing structure, and evaluate the legitimacy and trustworthiness of the company.

We will provide valuable information on how to avoid gold scams and answer frequently asked questions about Rosland Capital. Join us as we uncover the pros and cons of Rosland Capital’s gold IRA and provide a summary of our evaluation criteria.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

Hand picked top 5 trusted and best reviewed companies

Protect Your Retirement

Claim Your FREE Gold Kit Now

Key Takeaways

Rosland Capital Review: Overview

Rosland Capital, headquartered in Los Angeles, holds a prominent position in the precious metals industry, renowned for its dedication to transparency and customer service.

Founded by Marin Aleksov, the company has received recognition for its business practices and adherence to compliance standards, as demonstrated by its positive standing with the Better Business Bureau (BBB).

Setting itself apart through a broad array of offerings, including gold, silver, platinum, and palladium products, Rosland Capital caters to a wide range of investment preferences. Emphasizing the importance of educating customers on the nuances of investing in precious metals, the team at Rosland Capital offers personalized guidance to assist clients in making well-informed decisions.

Guided by Marin Aleksov, the company’s leadership team combines industry knowledge with a commitment to building strong relationships with both experienced investors and newcomers, fostering trust and dependability within the market.

Company Background

Rosland Capital offers a diverse array of products and services related to precious metals to meet the varied needs of customers in the market. The company’s unwavering commitment to quality and customer satisfaction is upheld by individuals like Nick Peyour, a key player in ensuring that Rosland Capital’s products adhere to the highest standards.

Focusing on providing customers with investment opportunities in gold, silver, platinum, and palladium, Rosland Capital has established itself as a reputable name in the precious metals sector. Nick Peyour, the Vice President of Marketing, plays a vital role in devising strategies to improve the customer experience and uphold the company’s reputation.

Despite occasional customer concerns, Rosland Capital’s dedication to transparency and integrity distinguishes them in the competitive market, making them a preferred option for those seeking to diversify their portfolios with precious metals.

Rosland Capital Customer Reviews

Customer reviews are incredibly important in shaping perceptions of Rosland Capital’s services, particularly in relation to its IRA offerings and interactions with sales representatives.

These testimonials provide a reflection of the experiences and satisfaction levels of clients who have utilized the company for their precious metal investment requirements.

Through sharing their firsthand encounters, customers offer valuable insights into how effectively Rosland Capital meets individual investment objectives and customer service expectations.

These reviews act as a lens through which to view the effectiveness of the IRA choices provided by Rosland Capital and offer illumination on the professionalism and expertise demonstrated by its sales representatives in assisting clients through the investment journey.

The overall levels of satisfaction expressed in these testimonials not only underscore the quality of service delivered but also impact potential clients’ decisions in selecting a dependable and trustworthy partner for precious metal investments.

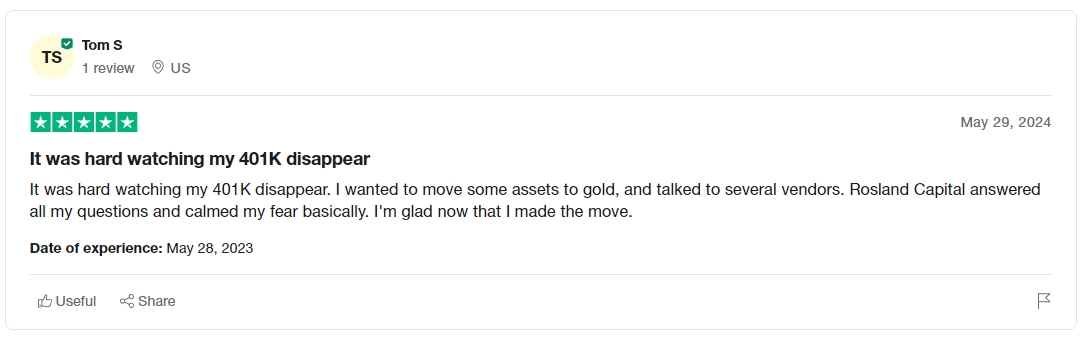

Recommendations from Customers

Customers have expressed their satisfaction with Rosland Capital’s outstanding customer service, highlighting the company’s distinctive offerings of coins and precious metals. These recommendations serve to emphasize the positive experiences that clients have enjoyed with Rosland Capital, showcasing its dedication to quality and ensuring customer satisfaction.

One particular aspect that has struck a chord with customers is the timely and well-informed assistance they receive when they make inquiries or place orders. Clients value the personalized care they are given, feeling appreciated and well-supported throughout their interactions.

The variety of coins offered by Rosland Capital, including rare and limited editions, has garnered acclaim for its uniqueness and potential for investment. The smooth purchasing process, along with transparent pricing and secure transactions, has contributed to many customers expressing high levels of satisfaction with Rosland Capital.

Protect Your Retirement

Claim Your FREE Gold Kit Now

Rosland Capital Services and Offerings

Rosland Capital provides a wide range of services encompassing various precious metal products, including Gold IRA products, Gold and Silver bullion, and Platinum and Palladium bars. These offerings cater to a diverse range of investment preferences, offering customers a variety of options to safeguard their financial futures.

For individuals interested in expanding their investment portfolio, Rosland Capital’s Gold IRA products present a tax-advantaged method of investing in physical gold. The Bullion choices offered by Rosland Capital afford investors a tangible asset with intrinsic value that acts as a safeguard against market fluctuations.

Meanwhile, for those inclined towards tangible investments, Rosland Capital’s assortment of precious metal bars, which includes Platinum and Palladium bars, provide a secure and dependable means of holding physical assets.

Gold IRA Products

Rosland Capital’s Gold IRA products are crafted to assist customers in securing their retirement savings through investments in tangible assets such as gold and silver. These products present a distinct opportunity for diversifying investment portfolios and shielding wealth from market fluctuations.

By incorporating gold and silver assets into their IRA accounts, investors can reap the advantages of holding physical precious metals as part of their retirement savings strategy. Throughout history, gold and silver have proven to be dependable stores of value, offering protection against inflation and economic uncertainties. Diversifying with these tangible assets can mitigate overall portfolio risk and bolster long-term wealth preservation.

Through Rosland Capital’s Gold IRA products, individuals have the flexibility to customize their retirement investments to align with their financial objectives and risk tolerance, resulting in a more resilient and well-rounded retirement portfolio.

Gold and Silver Bullion

Rosland Capital’s Gold and Silver bullion offerings provide customers with access to valuable precious metals, offering them the opportunity to invest in physical assets that maintain intrinsic value. These products present a reliable investment choice for individuals seeking to enhance the diversity of their portfolios with precious metals.

Gold and silver bullion are widely sought after due to their historical significance and their function as a safeguard against inflation. Investors value the stability and long-term growth potential associated with owning physical gold and silver.

Rosland Capital’s bullion offerings are available in various weights and designs, catering to both experienced investors and individuals exploring the realm of precious metals for the first time. By integrating gold and silver into their investment approach, individuals can protect their wealth and improve the overall diversification of their financial assets.

Platinum and Palladium Bars

Rosland Capital offers customers a distinctive investment opportunity in Platinum and Palladium bars, presenting a varied selection of products to cater to different investment preferences. These bars serve as a sophisticated option for investors seeking to enhance their portfolios with rare and valuable assets.

Platinum and Palladium are highly coveted metals renowned for their inherent value and stability in the investment sphere. Crafted with precision, Rosland Capital’s bars are synonymous with purity, making them an optimal choice for individuals in pursuit of tangible investments.

By incorporating Platinum and Palladium bars into their portfolios, investors can broaden their holdings beyond conventional stocks and bonds, thereby establishing a more robust and diversified investment approach. Leveraging Rosland Capital’s esteemed reputation for quality and dependability, customers can place their trust in the authenticity and worth of these precious metal bars.

Rosland Capital Pricing and Accessibility

Understanding the pricing structure and accessibility of Rosland Capital is crucial for individuals considering investing in precious metals. The company’s dedication to transparency regarding fees and user-friendly website ensures that customers can make well-informed decisions about their investments.

Rosland Capital provides various pricing models tailored to different customer requirements, including spot pricing and tiered pricing based on the quantity of metals purchased. This flexibility allows investors to select the option that aligns best with their financial objectives.

By offering a clear breakdown of fees on its website, Rosland Capital provides clients with a comprehensive understanding of the costs involved. This practice promotes trust and facilitates informed investment decisions. This emphasis on transparency distinguishes Rosland Capital in the industry, bolstering its reputation for providing customer-centric investment services.

Pricing Structure

Rosland Capital’s commitment to providing competitive fees across a wide range of products and services in the precious metals market is evident in its pricing structure. It is essential for investors aiming to optimize the returns on their investments to grasp the company’s pricing mechanism.

A fundamental aspect of Rosland Capital’s fee system is its transparency, which includes providing clients with detailed breakdowns of the costs associated with their investments. This transparency fosters trust and confidence among investors, assuring them that they are receiving fair value for their investments.

The cost-effectiveness of Rosland Capital’s pricing model makes it an appealing choice for individuals looking to diversify their portfolios with precious metals. By offering competitive fees while maintaining high-quality standards, Rosland Capital establishes itself as a frontrunner in the industry, providing a compelling value proposition to investors.

Accessibility and Contact Information

The accessibility and contact information provided by Rosland Capital are crucial in ensuring customer satisfaction and addressing any concerns or complaints that may arise. The company’s presence in Los Angeles, coupled with its positive reputation with the Better Business Bureau, highlights its dedication to transparency and dependable customer service.

Customers have multiple options to reach out to Rosland Capital, including a toll-free number, email support, and a live chat feature on their website. The company’s customer service team, known for their expertise and responsiveness, is always available to assist customers with inquiries, account management, or any other needs that may arise.

In instances where customers have complaints, Rosland Capital has implemented a structured process for efficient resolution, guaranteeing that any issues are handled promptly and professionally.

Pros and Cons of Rosland Capital Gold IRA

When assessing the advantages and disadvantages of Rosland Capital’s Gold IRA, it is important to consider various factors such as customer satisfaction levels, potential complaints, and the overall performance of the company in delivering IRA services. By carefully evaluating these aspects, investors can make well-informed decisions about whether to entrust their retirement savings to Rosland Capital.

A notable advantage of Rosland Capital’s Gold IRA offerings is the high level of customer satisfaction reported by many clients. These clients often praise the company’s responsive customer service and user-friendly processes. However, there are potential complaints regarding fees associated with account maintenance and transactions.

Despite these concerns, Rosland Capital has maintained a strong reputation in the industry for offering secure investment options and reliable performance. This underscores the company’s dedication to helping withdividuals in securing their financial futures through investments in precious metals.

Rosland Capital Legitimacy and Trustworthiness

Establishing Rosland Capital’s legitimacy and trustworthiness is crucial for investors considering engaging with the company. With a dedicated compliance officer overseeing operations and a positive reputation with the Better Business Bureau (BBB), Rosland Capital showcases its dedication to upholding industry standards and fostering customer trust.

The company’s dedication to compliance is evident in its meticulous adherence to regulatory guidelines, which offers customers a sense of security when navigating their precious metals investments. Rosland Capital’s transparency and accountability further bolster its reputation as a reliable partner in the financial realm.

The firm’s stellar BBB rating serves as a testament to its ethical business practices and steadfast commitment to customer satisfaction. Investors can rest assured knowing they are partnering with a reputable and dependable organization like Rosland Capital.

How to Avoid Gold Scams

The path to successful precious metal investments demands careful attention to avoid falling prey to gold scams that could jeopardize the financial well-being of investors. Recognizing warning signs, opting for reputable companies renowned for outstanding customer service, such as Rosland Capital, and conducting thorough due diligence are essential steps to help individuals steer clear of deceitful schemes.

It is imperative for investors to exercise caution when encountering deals that appear too good to be true, as scammers frequently entice victims with offers of unreasonably high returns. Vigilance is crucial; individuals must verify the authenticity of the gold being transacted and assess the credibility of the dealer.

Esteemed firms like Rosland Capital emphasize transparency and client contentment, instilling a sense of assurance in investors. By selecting a trustworthy company, investors can mitigate the likelihood of falling victim to fraudulent gold schemes and enjoy a more secure investment journey.

FAQs about Rosland Capital

Responding to frequently asked questions about Rosland Capital, its IRA offerings, and its reputation with the Better Business Bureau can provide investors with valuable insights before deciding to engage with the company. By offering clear and informative answers to common inquiries, Rosland Capital can promote transparency and build trust with potential clients.

As individuals contemplate investing in precious metals through their IRA, having a good grasp of Rosland Capital’s IRA options becomes crucial. Many prospective clients have questions about the types of precious metals permitted in IRA accounts and the procedures involved in establishing a Precious Metals IRA with Rosland Capital.

Investors often seek clarification regarding the management fees associated with a Precious Metals IRA and how they can monitor the performance of their investments. Addressing these inquiries can give the power to investors to make well-informed decisions.

Ownership Information

Understanding the ownership structure of Rosland Capital, including key figures such as the compliance officer Andrew V, offers investors valuable insights into the company’s leadership and organizational hierarchy. Clear knowledge of ownership details increases transparency and fosters trust in Rosland Capital’s operations.

Andrew V fulfills the role of compliance officer at Rosland Capital, responsible for ensuring regulatory compliance and maintaining the company’s adherence to legal standards. Plus Andrew V, Rosland Capital’s leadership lineup features experienced executives like CEO Jonathan M, who guides the company’s strategic course.

The collaborative efforts of pivotal figures like Andrew V and Jonathan M play a pivotal role in driving the company’s success and overall operational effectiveness. This robust leadership team cultivates a culture of accountability and excellence within Rosland Capital.

Investment Suitability

Evaluating the appropriateness of Rosland Capital’s offerings, especially concerning retirement savings and gold coins, is crucial for investors strategizing their financial futures.

Recognizing the inherent value of gold coins as a tangible asset that historically maintains its value can instill a sense of assurance in unpredictable economic conditions. When considering retirement savings, incorporating physical gold into a portfolio can serve as a safeguard against inflation and market instability.

Rosland Capital provides a variety of products tailored to different risk tolerances and investment horizons, enabling investors to customize their portfolios to align with specific financial goals. Whether aiming for long-term stability, capital preservation, or potential growth, gold coins present an enduring allure that transcends fluctuations in the market.

Legitimacy Confirmation

Verifying the credibility of Rosland Capital by considering factors such as its positive reputation with the Better Business Bureau and its establishment in Los Angeles helps bolster investor trust in the company’s activities.

The rating from the Better Business Bureau not only indicates Rosland Capital’s dedication to transparency and customer satisfaction but also offers clients a concrete gauge of the company’s dependability. With its physical presence in the dynamic financial center of Los Angeles, Rosland Capital further enhances its credibility, presenting a tangible and easily accessible location for conducting business.

These critical elements, when combined with the company’s history of honesty and expertise in the precious metals sector, serve as compelling factors for investors in search of a reliable and respected business partner.

Customer Satisfaction with Rosland Capital

Assessing customer satisfaction levels and effectively handling any complaints is crucial to Rosland Capital’s dedication to delivering exceptional service. By paying attention to business specifics and customer input, the company can continuously improve its offerings and ensure that customers receive the best possible support and guidance.

Through attentive listening and promptly addressing any issues that may arise, Rosland Capital seeks to foster an environment of trust and dependability. Customer feedback acts as a valuable tool in pinpointing areas for enhancement and innovation, enabling the company to adjust and progress in response to evolving needs.

By upholding high service benchmarks and consistently surpassing expectations, Rosland Capital aims to establish enduring relationships with its clientele, promoting loyalty and positive referrals within the market.

Evaluation Criteria for Rosland Capital

The process of assessing Rosland Capital involves establishing evaluation criteria that focus on factors like transparency in operations and the quality of customer service. By setting clear benchmarks for performance, investors can effectively evaluate the company’s credibility and reliability within the precious metals industry.

Transparency is a key aspect to consider when evaluating a company’s operations, as it indicates the extent to which the company is open in disclosing information to its stakeholders. In the case of Rosland Capital, transparency can be assessed by examining its disclosure of pricing structures, fees, and policies.

The quality of customer service also plays a significant role in determining overall customer satisfaction. Factors such as response time, professionalism, and problem resolution are critical considerations when assessing the customer experience provided by Rosland Capital.

Summary of Rosland Capital Gold IRA Review

Rosland Capital’s Gold IRA options offer investors a valuable way to protect their retirement savings through assets like gold. Utilizing these investment opportunities allows individuals to diversify their portfolios and shield their financial futures from economic uncertainties.

Gold has always been recognized as a stable store of value, making it an appealing choice for those aiming to preserve their wealth over the long haul. With Rosland Capital’s Gold IRA, investors can experience the advantages of owning physical gold while also potentially benefiting from tax advantages associated with retirement accounts.

This unique combination of asset protection and tax perks makes Gold IRAs an attractive option for individuals looking to establish a solid financial groundwork for their retirement years.

Frequently Asked Questions

What is Rosland Capital Review?

Rosland Capital Review is a comprehensive assessment of the precious metals company, Rosland Capital, that provides an overview of their products, services, reputation, and customer feedback.

How can I benefit from reading a Rosland Capital Review?

Reading a Rosland Capital Review can help you make an informed decision about whether to do business with the company. It can also provide valuable insights into their customer service, product quality, and overall reputation.

Is Rosland Capital a reputable company?

Yes, Rosland Capital is a reputable company with over a decade of experience in the precious metals industry. They are known for their high-quality products, reliable customer service, and secure storage options.

What products and services does Rosland Capital offer?

Rosland Capital offers a wide range of precious metals products, including gold, silver, platinum, and palladium. They also provide services such as IRA rollovers and storage options for their clients.

How can I contact Rosland Capital for more information?

You can contact Rosland Capital by calling their toll-free number at 1-800-461-1246 or by filling out a contact form on their website. They also have a live chat feature for immediate assistance.

Does Rosland Capital have any customer reviews or testimonials?

Yes, Rosland Capital has numerous customer reviews and testimonials on their website and other independent review sites. These reviews can give you valuable insights into the company’s reputation and customer satisfaction.

Protect Your Retirement

Claim Your FREE Gold Kit Now

Remember to read our list of the Top Gold Companies to see if Rosland Capital made the cut.

Or, if you like what you read about Rosland Capital, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.