Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Interested in investing in precious metals, rare coins, and collectibles? Private Bullion could be the right choice for you.

In this article, we’ll explore the history of Private Bullion, the products they offer, the benefits and risks of investing with them, and how to get started.

With a wide selection of products, competitive pricing, expert guidance, and secure storage options, Private Bullion is a reputable company to consider for your investment needs. Let’s dive in and explore further.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Click Here to Read Our Top 5 Gold Companies List

Hand picked top 5 trusted and best reviewed companies

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW __CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“90958”:{“name”:”Main Accent Light”,”parent”:”98bf6″,”lock”:{“lightness”:1}},”98bf6″:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default”,”value”:{“colors”:{“90958”:{“val”:”rgb(229, 235, 230)”,”hsl_parent_dependency”:{“h”:129,”l”:0.91,”s”:0.12}},”98bf6″:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431,”a”:1}}},”gradients”:[]},”original”:{“colors”:{“90958”:{“val”:”rgb(223, 245, 238)”,”hsl_parent_dependency”:{“h”:160,”s”:0.52,”l”:0.91,”a”:1}},”98bf6″:{“val”:”rgb(1, 170, 119)”,”hsl”:{“h”:161,”s”:0.98,”l”:0.33,”a”:1}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Table of Contents Heading 2 ExampleHeading 3 ExampleHeading 4 ExampleHeading 2 ExampleHeading 3 ExampleHeading 4 Example

Key Takeaways

- Private Bullion offers a wide selection of precious metals, rare coins, collectibles, and IRA eligible products for investors to choose from.

- Investing with Private Bullion comes with the benefits of competitive pricing, expert guidance, and secure storage options for your assets.

- As with any investment, there are risks involved such as fluctuation in market prices and potential for counterfeit products, so it’s important to do your research and consult with experts before investing with Private Bullion.

What is Private Bullion?

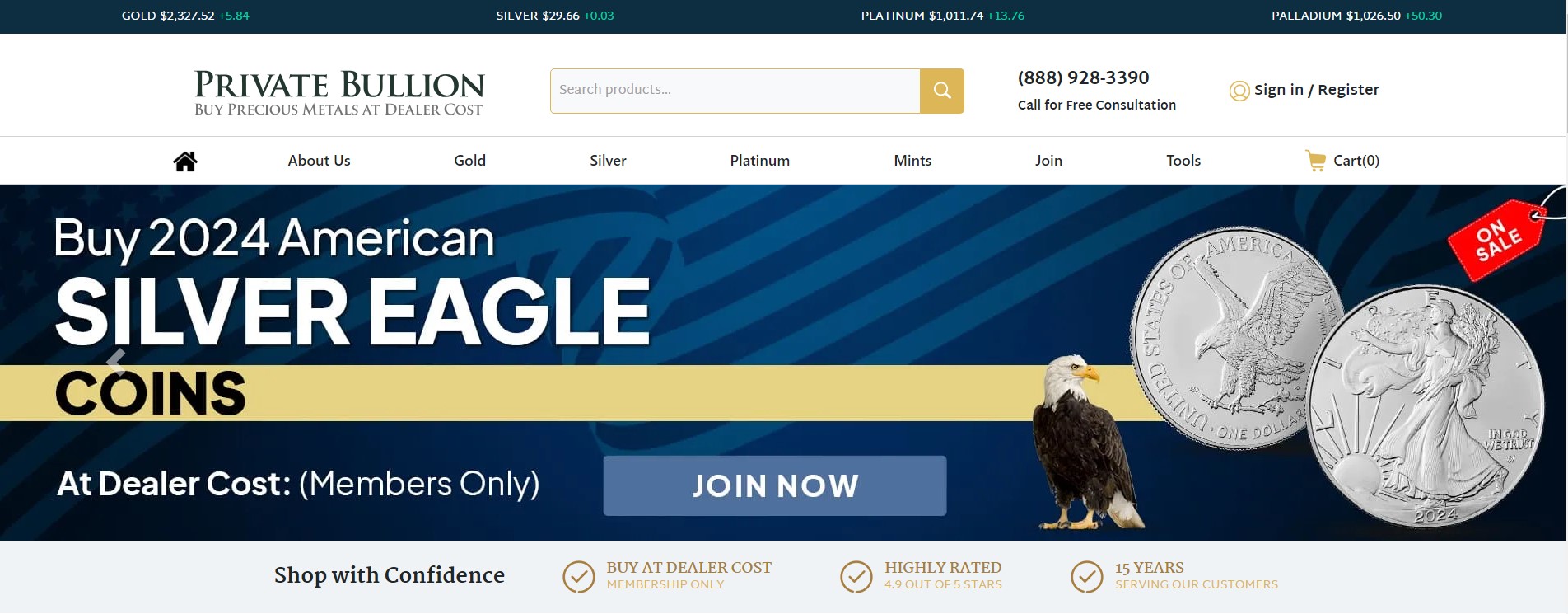

Private Bullion is a reputable company specializing in precious metals investments, offering a wide range of gold, silver, platinum, and palladium products, including options for a Gold IRA, aimed at providing investors with a secure and stable investment portfolio.

Plus their diverse range of precious metals, Private Bullion also provides valuable guidance and expertise on setting up and managing Gold IRAs, which act as a safeguard against economic uncertainties. Gold IRAs offer investors the opportunity to secure their wealth by holding physical gold within a tax-advantaged retirement account.

Private Bullion’s focus on transparency and customer education sets them apart in the industry, making them a trusted partner for those looking to diversify their investment portfolios and protect their assets against market volatility.

History of Private Bullion

Founded by Scott Hage, Private Bullion has a rich history rooted in its association with the Midwest Bullion Exchange, growing into a trusted name in the precious metals industry.

Initially established in the early 2000s, Private Bullion started as a modest operation, catering to a niche market of investors seeking to diversify their portfolios with precious metals. Through its commitment to providing top-notch service and high-quality products, the company quickly gained recognition for its integrity and reliability.

As the years passed, Private Bullion expanded its offerings to include a wide range of bullion products, from gold and silver bars to rare coins and collectibles. This diversification strategy, coupled with strategic partnerships and a customer-centric approach, fueled the company’s steady growth.

What Products Does Private Bullion Offer?

Private Bullion offers a diverse range of products including gold, silver, platinum, and palladium items, alongside collectible coins designed to meet various investment needs.

Precious Metals

Private Bullion specializes in a wide array of precious metals, including gold, silver, platinum, and palladium products, each designed to cater to the diverse needs of investors.

Gold, known for its stability and value retention over time, is a popular choice for those looking to hedge against economic uncertainties. Silver, with its industrial applications, offers both investment and utilitarian benefits, making it a versatile option.

Platinum, often referred to as the ‘white metal,’ is coveted for its rarity and high resistance to tarnishing. On the other hand, palladium, a lesser-known but increasingly sought-after metal, is prized for its use in catalytic converters and electronics.

Private Bullion provides a range of investment products in these precious metals, such as coins, bars, and rounds, offering investors a tangible and secure way to diversify their portfolios.

Rare Coins

Private Bullion provides a selection of rare coins, including highly sought-after pre-1933 coins, which are of significant interest to collectors and investors alike.

Rare coins come in various categories, from ancient Roman coins to American Eagles and Gold Sovereigns. Each type carries its own historical significance and uniqueness, making them more than just pieces of metal. For instance, the Saint-Gaudens Double Eagle, minted from 1907 to 1933, is celebrated for its intricate design by renowned sculptor Augustus Saint-Gaudens.

Investing in rare coins not only adds diversity to your investment portfolio but also serves as a tangible piece of history that is often cherished by collectors. The monetary value of these coins can appreciate over time, making them a smart long-term investment choice.

Collectibles

Plus precious metals, Private Bullion offers a range of collectibles, including unique collectible coins and junk silver, appealing to both investors and numismatists.

These collectibles span a diverse array of items, from rare historical coins to limited-edition commemorative pieces. The unique attributes of these collectibles lie in their intricate designs, historical significance, and limited availability, making them coveted pieces for collectors worldwide. The appeal of these items goes beyond mere monetary value; collectors are drawn to the stories and history behind each piece, creating a tangible connection to the past.

Private Bullion’s collectibles offer not only a tangible asset but also a piece of history that can be cherished for generations. From ancient coins to modern mint issues, each item tells a unique story that adds to its allure. For collectors looking to diversify their portfolios, these items not only provide aesthetic pleasure but can also potentially appreciate in value over time, serving as a lucrative investment opportunity.

IRA Eligible Products

Private Bullion offers a range of IRA-eligible bullion products, making it easier for investors to include gold, silver, platinum, and palladium in their Gold IRA or Roth IRA accounts.

Investing in IRA-eligible products such as precious metals provides a diversified approach to retirement planning. These products act as a hedge against economic uncertainties and market volatility, safeguarding one’s savings for the future. By incorporating gold, silver, platinum, or palladium in your IRA, you not only diversify your portfolio but also enjoy potential long-term growth and protection against inflation.

Adding these precious metals to your IRA is a straightforward process. Once you’ve chosen the products, your provider can assist in the necessary paperwork and transfer of funds. With a Gold IRA, you can benefit from tax advantages and the security of physical assets backed by the intrinsic value of precious metals.

What Are the Benefits of Investing with Private Bullion?

Investing with Private Bullion presents numerous benefits, including exceptional customer service, secure storage solutions, and efficient liquidation services, ensuring a comprehensive and satisfying investment experience.

Wide Selection of Products

Private Bullion boasts a wide selection of products, including a diverse range of gold, silver, platinum, and palladium items, catering to various investment preferences and goals.

Investors can choose from a plethora of options, such as bullion bars, coins, and rounds in different weights and purities, allowing for flexibility in building a well-rounded investment portfolio.

Each product undergoes stringent quality checks to ensure authenticity and purity, providing peace of mind to investors. Private Bullion’s product range includes both traditional and modern designs, appealing to a broad spectrum of investors, from beginners to seasoned collectors.

Competitive Pricing

Private Bullion offers competitive pricing on all their precious metals products, ensuring that investors receive the best value for their investments.The importance of competitive pricing in the precious metals market cannot be understated. It plays a crucial role in attracting investors and helping them maximize their returns. When comparing Private Bullion’s pricing to other companies in the industry, it becomes evident that they prioritize offering fair and transparent prices. This not only instills trust in their customers but also ensures that they are getting a competitive deal.Investing with a company that provides fair prices comes with a multitude of benefits. It gives investors peace of mind knowing that they are not overpaying for their investments. Fair pricing allows for better profit margins and can result in higher returns in the long run.

Expert Guidance

Private Bullion provides expert guidance to its customers, including resources like the Precious Metals IRA Investor’s Guide, to help investors make informed decisions.

Private Bullion offers personalized consultations with experienced financial advisors who can provide tailored recommendations based on individual investment goals and risk tolerance. This one-on-one guidance ensures that investors receive targeted advice to navigate the complexities of precious metals investing.

Private Bullion hosts educational webinars and workshops to further enable investors with knowledge about market trends, investment strategies, and IRA regulations. These resources enable investors to stay well-informed and up-to-date on industry developments, giving them an edge in making strategic investment decisions.

Secure Storage Options

Private Bullion offers secure storage options through partnerships with reputable facilities such as the Delaware Depository, Bank of Nova Scotia, Via MAT International, and Lloyd’s of London.

Having secure storage for precious metals is crucial for investors looking to safeguard their assets. These storage facilities not only provide top-of-the-line security measures, but also offer peace of mind knowing that their valuable metals are in safe hands.

Partnering with trusted institutions ensures that the storage locations have a solid reputation for security and reliability. This partnership allows investors to store their metals with confidence, knowing that they are protected by institutions known for their integrity and commitment to safety.

What Are the Risks of Investing with Private Bullion?

While investing with Private Bullion offers many benefits, it’s important to consider the risks, such as fluctuations in market prices and the potential for counterfeit products.

Fluctuation in Market Prices

The market prices of precious metals can fluctuate significantly, affecting the value of investments made through Private Bullion. These fluctuations are influenced by various factors such as global economic conditions, geopolitical events, supply and demand dynamics, and investor sentiment.

For example, a sudden economic downturn in a major market can lead to a decrease in demand for precious metals, causing their prices to drop. On the other hand, political unrest or uncertainty can drive investors to seek safe-haven assets like gold, leading to price spikes.Market price fluctuations can have a direct impact on the portfolios of investors who hold precious metals. When prices are high, their investments gain value, but if prices plummet, so does the overall worth of their portfolios.To mitigate this risk, investors can employ diversification strategies, such as spreading their investments across different asset classes, including stocks, bonds, and real estate, to cushion the impact of price fluctuations in precious metals.Staying informed about market trends is crucial for investors looking to navigate through the volatility of precious metals. By keeping abreast of news related to the economy, politics, and global events, investors can make more informed decisions about when to buy, sell, or hold their precious metal investments.They can also utilize technical analysis tools and consult with financial experts to gain insights into potential market movements and develop effective risk management strategies.

Potential for Counterfeit Products

The potential for counterfeit products is a risk in the precious metals market, but Private Bullion employs stringent measures to ensure the authenticity of its offerings.

Counterfeit products pose a significant threat to both consumers and businesses operating in the precious metals industry. These fake items not only deceive buyers into purchasing low-quality or illegitimate products, but they also undermine the integrity of the entire market.

Private Bullion recognizes the importance of authenticity and places a high priority on verifying the quality and genuineness of their offerings. By implementing robust authentication processes and working closely with trusted suppliers and experts in the field, Private Bullion aims to provide customers with peace of mind and assurance when investing in precious metals.

How to Get Started with Private Bullion?

Getting started with Private Bullion is straightforward; prospective investors can begin by consulting the Precious Metals IRA Investor’s Guide and reaching out to the company’s expert advisors.

Once you have familiarized yourself with the comprehensive information provided in the guide, the next step involves scheduling a consultation with one of Private Bullion’s knowledgeable advisors. During this consultation, you can discuss your financial goals, risk tolerance, and investment preferences to help determine the best strategy for you. These expert advisors are equipped to answer any questions you may have and offer personalized recommendations based on your individual needs.

After the consultation, you will be guided through the process of selecting the right precious metals products to add to your investment portfolio. Private Bullion provides a wide range of options, including gold, silver, platinum, and palladium, allowing you to diversify your holdings effectively.

Customer Reviews of Private Bullion

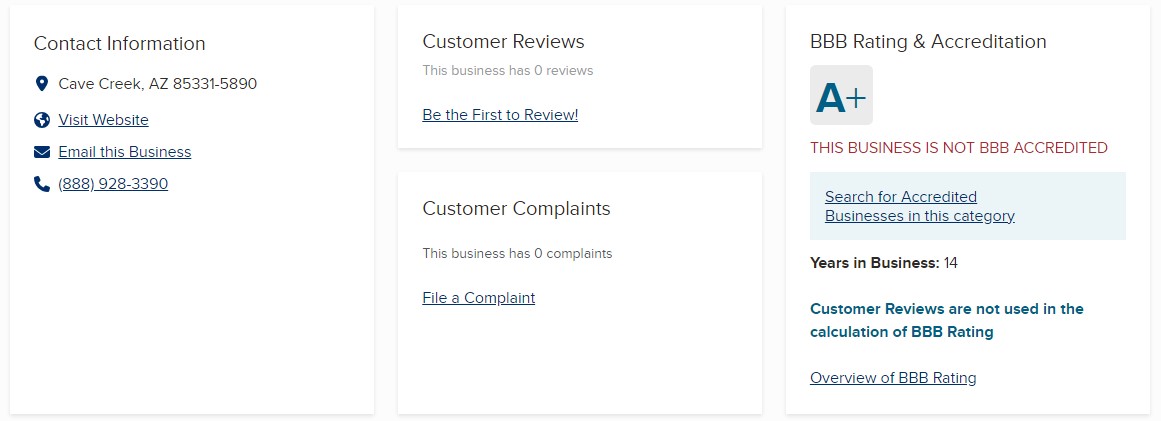

Customer reviews of Private Bullion are generally positive, with high ratings on platforms such as BBB, Trustpilot, and Yelp, reflecting the company’s commitment to excellent service.

Customers frequently mention the professionalism of Private Bullion’s staff, praising their knowledge and willingness to go the extra mile to assist clients. Many reviewers appreciate the seamless transaction process and prompt delivery times, indicating a high level of customer satisfaction with the overall service experience. Trustworthiness is a recurring theme in the reviews, with customers highlighting the company’s transparency and honesty in their dealings.

Is Private Bullion a Legitimate Company?

Private Bullion is a legitimate company, listed on Bullion.Directory, ensuring transparency and trustworthiness in their operations.

Private Bullion holds accreditations from well-respected organizations like the London Bullion Market Association (LBMA) and is a member of the World Gold Council, further solidifying their credibility in the precious metals industry. Their compliance with ISO 9001 quality management standards underscores their commitment to maintaining high standards of service.

Private Bullion has also undergone independent audits by renowned auditing firms, reaffirming their commitment to transparency and accountability in their business practices. The rave reviews from satisfied customers and positive ratings on trusted review platforms like Trustpilot serve as a testament to their exceptional service quality.

Frequently Asked Questions

How can I access Private Bullion’s services?

Private Bullion offers its services through its website, https://privatebullion.com/. Investors can register and open an account to start investing in precious metals.

What are the benefits of investing with Private Bullion?

Private Bullion offers a wide range of benefits to its investors, including competitive pricing, a secure and insured storage facility, and personalized consultation services. They also ensure complete privacy and confidentiality for their clients.

Is Private Bullion a reputable company?

Yes, Private Bullion has been in the precious metals industry for over 20 years and has a solid reputation for providing transparent and reliable services. They are also accredited by the Better Business Bureau with an A+ rating.

Can I invest in any type of precious metal with Private Bullion?

Private Bullion offers a variety of precious metals for investment, including gold, silver, platinum, and palladium. They also offer different investment options, such as bullion coins and bars, to cater to the diverse needs of their clients.

Does Private Bullion offer any educational resources for investors?

Yes, Private Bullion has a section on their website dedicated to educating investors about precious metals, their value, and how to invest in them. They also offer personalized consultation services to guide investors in making informed decisions about their investments.

Conclusion

Final Verdict: Should You Invest with Private Bullion?

Considering the extensive range of services, expert guidance, and secure storage options, Private Bullion stands out as a reliable option for investing in precious metals, making it a viable choice for both novice and experienced investors.

The personalized approach offered by Private Bullion gives investors peace of mind, knowing their investments are in capable hands. The transparency in pricing and transactions fosters trust and confidence among clients.

With a track record of delivering consistent returns and maintaining a strong reputation in the industry, Private Bullion has established itself as a trusted partner for those seeking to diversify their portfolios.

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

Remember to read our list of the Top Gold Companies to see if Private Bullion made the cut.

>> Click HERE to read our 5 Best Gold IRA Companies list <<

Or, if you like what you read about Private Bullion, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.