Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Have you thought about investing in precious metals like gold and silver? If so, you may have come across BullionVault, a platform that lets you buy, sell, and store these valuable assets.

In this detailed review, we’ll explain how BullionVault works, break down its fees and charges, and weigh the pros and cons of using the platform. We’ll also explore its safety measures, legitimacy, and customer reviews, while comparing it to other gold investment options.

Let’s dive into the world of BullionVault and help you decide if it’s the right fit for your investment strategy.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Click Here to Read Our Top 5 Gold Companies List

Hand picked top 5 trusted and best reviewed companies

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW __CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“90958”:{“name”:”Main Accent Light”,”parent”:”98bf6″,”lock”:{“lightness”:1}},”98bf6″:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default”,”value”:{“colors”:{“90958”:{“val”:”rgb(229, 235, 230)”,”hsl_parent_dependency”:{“h”:129,”l”:0.91,”s”:0.12}},”98bf6″:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431,”a”:1}}},”gradients”:[]},”original”:{“colors”:{“90958”:{“val”:”rgb(223, 245, 238)”,”hsl_parent_dependency”:{“h”:160,”s”:0.52,”l”:0.91,”a”:1}},”98bf6″:{“val”:”rgb(1, 170, 119)”,”hsl”:{“h”:161,”s”:0.98,”l”:0.33,”a”:1}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Table of Contents Heading 2 ExampleHeading 3 ExampleHeading 4 ExampleHeading 2 ExampleHeading 3 ExampleHeading 4 Example

Key Takeaways

- Easy and convenient way to invest in precious metals

- Low trading fees

- High security and insurance for stored metals

What Is BullionVault?

BullionVault is a leading platform that allows investors to buy, sell, and store precious metals such as gold, silver, and platinum securely and conveniently. The company offers a user-friendly interface and a range of services designed to meet the needs of both new and experienced investors.

![]()

Founded in 2005, BullionVault has grown to become an internationally recognized name in the secure storage of precious metals. With a mission to provide easy access to physical bullion, their innovative approach has revolutionized the way individuals can invest in gold and silver.

BullionVault’s commitment to exceptional customer service sets them apart in the industry. Their team of experts is dedicated to assisting clients with any queries and ensuring a smooth and transparent trading experience.

How Does BullionVault Work?

BullionVault operates as an online platform that facilitates the trading and secure storage of physical precious metals, providing investors with a straightforward and cost-effective way to manage their investments.

Opening an Account

Opening an account on BullionVault is a simple process that involves providing personal information, completing verification steps, and making an initial deposit to start trading.

To get started, the first step is to visit the BullionVault website and click on the ‘Open an Account’ button. You will be directed to fill out a registration form where you will provide your full name, email address, and create a secure password.

Once this information is submitted, you will need to verify your identity by uploading scanned copies of your identification documents, such as a passport or driver’s license. You may need to provide proof of address, like a utility bill or bank statement.

Buying and Selling Gold and Silver

Buying and selling gold and silver on BullionVault is conducted through a live market where prices are updated in real-time, allowing investors to make informed decisions based on current market conditions.

When placing a buy order, investors specify the quantity of precious metals they want to purchase and the maximum price they are willing to pay. On the other hand, a sell order involves indicating the amount of gold or silver to sell along with the minimum price acceptable.

The market pricing on BullionVault reflects supply and demand dynamics, influencing the buying and selling prices. Through market analytics, investors analyze historical trends, charts, and indicators to forecast potential future price movements, aiding them in strategic decision-making.

Storage and Insurance

BullionVault offers secure storage for precious metals in various international vault locations, including London, Zurich, and Singapore. The stored metals are fully insured to provide protection and peace of mind for investors.

Storage options provided by BullionVault include allocated storage, where specific bars are allocated and segregated, and unallocated storage where metals are owned collectively. Allocated storage ensures clients’ metals are separate from the company’s assets.

Meanwhile, the insurance coverage offered by reputable providers such as Lloyds of London safeguards against theft, damage, or loss.

BullionVault employs stringent security measures at their partner vaults, which are operated by companies like Via Mat, Brinks, and Malca-Amit. These vaults feature advanced security systems, 24/7 monitoring, biometric access controls, and regular audits to maintain the highest level of security for clients’ assets.

What Are the Fees and Charges?

BullionVault’s fee structure includes trading fees, storage fees, and insurance fees, all of which are transparent and designed to provide cost-effective solutions for investors.

Trading Fees

Trading fees on BullionVault are based on commission rates that vary depending on the transaction volume, with competitive pricing to ensure cost-effective trading for investors.Commission rates on BullionVault are structured to provide flexibility and fairness to traders. The tiered pricing system means that as the trading volume increases, the commission rates may decrease, allowing high-volume traders to benefit from lower costs.

Traders may be eligible for discounts or special offers based on their trading activity or account status, further enhancing the value proposition on the platform.

Storage Fees

Storage fees at BullionVault are calculated based on the amount of precious metals stored and the specific vault location chosen by the investor.These fees are typically charged on a monthly basis and vary depending on the level of storage required. Investors can choose from a range of vault locations strategically positioned across multiple countries, offering secure storage solutions to meet individual preferences.There may be additional costs associated with long-term storage, such as insurance fees to protect the stored assets and administrative charges for account maintenance.

Insurance Fees

Insurance fees on BullionVault cover the cost of protecting stored metals, with policies designed to provide comprehensive coverage against potential risks.These insurance policies ensure that investors’ precious metals are safeguarded from theft, physical damage, and other unforeseen events. The fees are calculated based on the value and type of metals being stored, as well as the total amount of insurance coverage required.BullionVault offers a variety of protection levels to cater to different investor needs, ranging from standard coverage to enhanced insurance plans that provide additional security measures. This not only gives investors peace of mind but also ensures that their investments are well-protected at all times.

What Are the Pros of Using BullionVault?

Using BullionVault offers numerous advantages for investors, including a user-friendly platform, low trading fees, and high security for stored metals.

Easy and Convenient Way to Invest in Precious Metals

BullionVault provides an easy and convenient way for investors to buy, sell, and store precious metals through its user-friendly interface and comprehensive online platform.

The platform’s intuitive design allows users to navigate seamlessly, making the process of investing in precious metals straightforward for both beginners and experienced investors alike. Customer support is readily available to assist with any queries or concerns, ensuring a smooth experience from account setup to bullion trading.

With features such as real-time market updates and secure storage facilities, investors can make informed decisions confidently. The accessibility options cater to a wide range of users, enhancing inclusivity and convenience in managing their precious metal investments.

Low Trading Fees

One of the major advantages of using BullionVault is its low trading fees, which are designed to be cost-effective and competitive compared to other investment options.Low trading fees play a crucial role in the world of investing, especially when it comes to precious metals and commodities. Investors can benefit significantly from reduced costs, allowing them to maximize their returns.Lower fees mean more money stays in your pocket, enhancing profitability over time. BullionVault’s commission rates stand out as being notably lower than many other platforms, giving investors a clear advantage. By keeping expenses in check, investors can potentially save substantial amounts in the long run while still accessing a reliable and efficient trading platform.

High Security and Insurance for Stored Metals

BullionVault ensures high security and comprehensive insurance for stored metals, providing investors with peace of mind that their assets are well-protected in secure vault locations.

Security at BullionVault is of utmost importance, employing advanced technologies like biometric scanners, video surveillance, and round-the-clock monitoring to safeguard the precious metals.

Their insurance coverage protects against theft, damage, and other unforeseen events, ensuring that the value of the stored assets is fully safeguarded. Storing metals in these highly secure vaults not only mitigates risks but also offers liquidity and accessibility for investors, making it a reliable choice for those looking to protect and grow their wealth.

What Are the Cons of Using BullionVault?

Despite its many advantages, BullionVault has some limitations and potential drawbacks that investors should be aware of, including a limited selection of precious metals and the lack of physical possession of metals.

Limited Selection of Precious Metals

BullionVault offers a limited selection of precious metals, focusing primarily on gold, silver, and platinum, which may not meet the needs of investors looking for a wider variety of options.

This limited selection can hamper diversification strategies for investors who seek exposure to a more extensive range of metals, such as palladium, rhodium, or other commodities. While gold, silver, and platinum are traditional favorites, including a broader selection can help mitigate risks and enhance portfolio stability.

In comparison, platforms like Kitco or JM Bullion offer a more diverse range of metals, catering to the preferences of investors with a broader scope of choices to tailor their portfolios to their specific investment goals.

No Physical Possession of Metals

One of the notable drawbacks of using BullionVault is that investors do not have physical possession of their metals, as all assets are stored in secure vaults managed by the platform.

While some investors may prefer having direct access to their tangible assets, the secure storage at BullionVault offers numerous benefits. By entrusting the platform with the safekeeping of precious metals, investors alleviate concerns about theft, damage, or inadequate storage conditions.

This arrangement ensures that asset security is upheld to the highest standards, providing peace of mind and allowing investors to focus on their investment strategies without worrying about the physical handling of their metals.

Potential for Market Manipulation

Like any trading platform, BullionVault is not immune to potential market manipulation, which can affect the prices of precious metals and create volatility in the market. Market manipulation poses significant risks to investors as it can lead to distorted prices and undermine the integrity of financial markets.

In response to these concerns, BullionVault has implemented various safeguards to protect its users. These include stringent compliance measures, regular audits, and transparent reporting practices. BullionVault adheres to regulatory standards set by authorities to ensure fair and transparent trading environment.

By prioritizing customer security and market integrity, BullionVault aims to mitigate the risks associated with market manipulation and promote a trustworthy trading experience for its users.

Is BullionVault Safe and Legit?

BullionVault is widely regarded as a safe and legitimate platform, backed by strong regulatory compliance, transparent operations, and a reputation for trustworthiness in the precious metals market.

One of the key aspects highlighting BullionVault’s credibility is its compliance with regulatory standards such as being regulated by the Financial Conduct Authority in the UK, ensuring that the platform operates under strict guidelines to protect customers’ interests.

Moreover, BullionVault’s customer reviews further attest to its safety, with many users praising the platform’s efficiency, security measures, and overall user experience. Industry recognition in the form of awards and partnerships also solidify BullionVault’s position as a reputable and trustworthy platform in the precious metals industry.

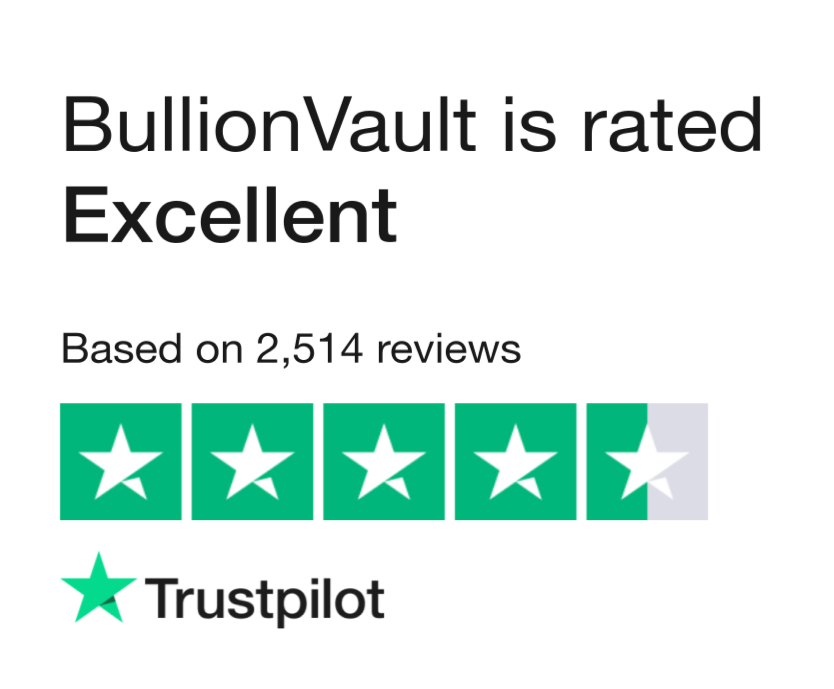

What Are the Customer Reviews and Ratings?

Customer reviews and ratings for BullionVault are generally positive, with many users praising the platform for its ease of use, customer support, and reliable services.

Many customers have highlighted BullionVault’s user-friendly interface as a standout feature, making it easy for both beginners and experienced investors to navigate the platform effortlessly.

In addition, the prompt and helpful customer support has been mentioned repeatedly in reviews, with users expressing gratitude for the quick responses and knowledgeable assistance provided.

Another common theme in the feedback is the trustworthiness of BullionVault’s services, with customers commending the platform for its reliability in executing transactions and securely storing precious metals.

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

How Does BullionVault Compare to Other Gold Investment Options?

BullionVault offers a unique approach to gold investment compared to other options, such as physical gold ownership, online gold dealers, and gold ETFs, each with its own set of advantages and disadvantages.

Comparison to Physical Gold Ownership

Compared to physical gold ownership, BullionVault offers the advantage of secure storage and easier management, eliminating the need for transportation and personal safekeeping of gold.

When you own physical gold, you have to take responsibility for storing it securely, often requiring costly security measures and insurance. On the other hand, using BullionVault, your gold is stored in professional vaults, fully insured and audited regularly for added peace of mind. Not only does this ensure the safety of your investment, but it also simplifies the process of buying and selling.

With BullionVault, you have the flexibility to trade gold in smaller increments, making it easier to liquidate your assets when needed. This contrasts with physical gold ownership, where selling large quantities can be more challenging and time-consuming.

In essence, while physical gold ownership may offer a tangible sense of possession, using BullionVault provides a convenient and secure alternative that streamlines the management of your precious metals.

Comparison to Other Online Gold Dealers

When compared to other online gold dealers, BullionVault stands out for its low trading fees and user-friendly interface, making it an attractive option for both new and experienced investors.

Many online gold dealers charge high fees for buying and selling gold, eating into investors’ profits. BullionVault, on the other hand, offers competitive fees that are significantly lower, allowing investors to maximize their returns.

The platform’s intuitive design and easy-to-navigate interface make trading gold a seamless experience, even for those new to investing in precious metals. This combination of affordability and usability sets BullionVault apart from its competitors in the online gold market.

Comparison to Gold ETFs

Gold ETFs offer a different approach to gold investment compared to BullionVault, focusing more on market conditions and investment management rather than physical ownership of metals.

When investing in Gold ETFs, investors do not own physical gold; instead, they hold shares backed by gold assets managed by the fund. This indirect exposure means that ETF prices are influenced by market fluctuations and demand-supply dynamics.

On the other hand, with BullionVault, investors directly own physical gold bullion stored securely in vaults around the world. This provides a sense of tangible asset ownership, offering protection against market volatility and potential economic uncertainties.

Frequently Asked Questions

What is Bullion Vault and how does it work?

Bullion Vault is an online platform that allows users to buy, sell, and store physical gold and silver bullion. It works by connecting buyers and sellers, providing a secure vault storage for the bullion, and facilitating the buying and selling process.

Is Bullion Vault a reputable company?

Yes, Bullion Vault is a highly reputable company with over 15 years of experience in the industry and over $3 billion worth of gold and silver stored for its clients. It has also received numerous awards and accolades for its services.

How do I open an account with Bullion Vault?

Opening an account with Bullion Vault is a simple process. All you need to do is visit their website and click on the “Open An Account” button. You will then be prompted to provide some personal information, verify your identity, and fund your account.

What are the fees associated with using Bullion Vault?

Bullion Vault charges a storage fee of 0.12% per year for gold and 0.48% per year for silver, based on the total value of your holdings. There is also a small transaction fee for buying and selling bullion on the platform.

Is my bullion safe with Bullion Vault?

Yes, your bullion is extremely safe with Bullion Vault. They use state-of-the-art security measures such as physical guards, 24/7 surveillance, and multiple layers of encryption to ensure the safety and security of your precious metals.

Can I sell my bullion at any time with Bullion Vault?

Yes, you can sell your bullion at any time with Bullion Vault. They offer instant liquidity, which means you can sell your bullion and receive funds within 24 hours. This makes Bullion Vault a flexible and convenient option for buying and selling precious metals.

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

Remember to read our list of the Top Gold Companies to see if BullionVault made the cut.

>> Click HERE to read our 5 Best Gold IRA Companies list <<

Or, if you like what you read about BullionVault, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.