Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Interested in investing in precious metals but not sure where to start?

Look no further than Lear Capital. This article will explore what Lear Capital is all about, the products and services they offer, and how they can help you diversify your investment portfolio.

We will also discuss the benefits of investing with Lear Capital and compare them to other precious metals companies.

Whether you’re a seasoned investor or just starting out, Lear Capital has something to offer for everyone.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

Hand picked top 5 trusted and best reviewed companies

Protect Your Retirement

Claim Your FREE Gold Kit Now

What is Lear Capital?

Since its establishment in the early 1990s, Lear Capital has a strong track record of navigating through volatile markets and guiding investors towards stability and growth. The company’s core mission is centered around enableing clients to secure their financial futures by utilizing the advantages of precious metals.

Lear Capital places great emphasis on transparency, integrity, and customer satisfaction, which has earned it a stellar reputation in the industry for its ethical business practices. Recognized for its exceptional customer service and innovative investment solutions, Lear Capital has solidified its position as a leader in the precious metals investment sector.

What Products and Services Does Lear Capital Offer?

Lear Capital offers a diverse range of products and services, encompassing investment opportunities in gold, silver, platinum, and various other precious metals. With options ranging from IRA accounts to physical coins and bars, Lear Capital presents a wide array of avenues through which individuals can invest in precious metals.

Investors have the flexibility to select from various metals like gold coins, silver bars, platinum bullion, and even rare collectible coins. Lear Capital’s IRA account offerings are tailored to suit different investment objectives, whether focusing on long-term wealth preservation or retirement planning.

An outstanding feature of Lear Capital is its extensive collection of graded and certified coins, providing customers with assurance regarding the authenticity and quality of their investments. The company also offers personalized guidance and expert insights to assist clients in making well-informed decisions within the dynamic precious metals market.

1. Gold and Silver IRA

Investing in a Gold and Silver IRA through Lear Capital offers individuals a secure and stable option for their retirement savings. This investment provides the potential for long-term growth and safeguards against economic uncertainties, bringing peace of mind to investors.

Diversifying your retirement portfolio by including precious metals like gold and silver introduces a tangible asset that can serve as a hedge against inflation and currency devaluation. Lear Capital simplifies the process of opening an IRA account, offering guidance that makes setup effortless.

Their team of experts is readily available to provide valuable insights and support, ensuring that you make informed investment decisions aligned with your financial goals and risk tolerance.

Protect Your Retirement

Claim Your FREE Gold Kit Now

2. Precious Metals Investment

Lear Capital’s Precious Metals Investment options are designed for individuals interested in diversifying their investment portfolios with valuable metals like gold, silver, and platinum. With competitive pricing and a diverse range of coins and bullion, Lear Capital ensures that investors have access to high-quality products to meet their investment requirements.

Investing in precious metals can serve as a hedge against inflation and economic uncertainties, making them a popular choice among long-term investors. Gold, for instance, has a history of retaining its value and is often considered a safe haven asset during periods of market instability.

Silver and platinum also offer distinctive benefits, including industrial applications and increasing demand across various sectors. Lear Capital’s expertise in the precious metals market equips investors to make well-informed decisions and potentially benefit from the long-term growth prospects of these valuable assets.

3. Gold and Silver Coins and Bars

Investing in Gold and Silver Coins and Bars through Lear Capital presents investors with physical assets that possess intrinsic value and act as a safeguard against economic fluctuations. Emphasizing transparency and competitive pricing, Lear Capital offers a diverse selection of coins and bars tailored for investment purposes.

These tangible assets offer a concrete form of diversification that can protect one’s wealth during periods of market uncertainty. Recognizing the significance of physical bullion in a well-rounded investment portfolio, Lear Capital provides a variety of options to accommodate different investor preferences.

Whether individuals are interested in purchasing gold or silver coins for long-term wealth preservation or engaging in the active trading of bars for potential short-term gains, Lear Capital’s adaptable pricing structure caters to a broad spectrum of investment objectives.

4. Other Investment Options

Lear Capital not only offers traditional precious metals investments but also provides a variety of other investment options to meet the diverse needs of investors. From IRA accounts to secure storage solutions, Lear Capital offers comprehensive services for individuals seeking to develop a strong investment portfolio.

Investing in IRA accounts through Lear Capital offers a tax-efficient method to increase wealth for retirement while taking advantage of potential market growth. By employing secure storage solutions, the safety and integrity of your investment holdings are ensured.

By diversifying your portfolio with these alternative options, investors can reduce risks and capitalize on opportunities in various asset classes, tailored to their financial objectives.

Lear Capital’s individualized guidance and expertise in investment management enable clients to make well-informed decisions and navigate the intricacies of the financial market with confidence.

How Does Lear Capital Work?

Lear Capital prides itself on guiding customers through a seamless investment process that places utmost importance on satisfaction and exceptional customer service. Emphasizing transparency and reliability, Lear Capital ensures that clients are provided with the necessary support and guidance to make well-informed investment decisions.

Beginning with the initial consultation and extending to the selection of the appropriate mix of precious metals, every phase at Lear Capital is crafted to meet the distinct requirements of each individual client.

The committed team at Lear Capital is always on hand to address any questions or concerns, nurturing a lasting relationship founded on trust and individualized attention. Post-investment, clients receive the benefits of continuous monitoring and expert advice to guarantee that their investments are in line with their financial objectives.

By prioritizing the client’s best interests, Lear Capital establishes a high standard for customer experience within the precious metals investment sector.

Protect Your Retirement

Claim Your FREE Gold Kit Now

1. Consultation and Education

Lear Capital provides personalized consultations and educational resources to assist clients in making well-informed investment decisions. By offering detailed reviews and expert guidance, Lear Capital ensures that investors are equipped with the necessary knowledge and support to navigate the intricacies of the precious metals market.

Clients who choose to work with Lear Capital receive customized investment advice that considers their individual financial objectives and risk tolerance. The company’s educational services extend beyond mere information provision; they enable clients with a deeper comprehension of market trends, pricing dynamics, and strategic investment strategies.

Lear Capital’s team of experienced advisors simplifies complex concepts, allowing investors to make informed decisions regarding their precious metals portfolios.

2. Purchasing and Delivery Process

The purchasing and delivery process at Lear Capital is designed with efficiency and convenience in mind for investors. By ensuring prompt order processing and timely delivery, Lear Capital guarantees that clients receive their precious metals promptly, allowing them to capitalize on investment opportunities.

As soon as a client places an order, Lear Capital’s expert team moves swiftly to confirm the transaction details and securely prepare the shipment. Through partnerships with reputable shipping carriers, clients have the ability to track their packages in real-time, providing an added layer of transparency and security to the delivery process.

Lear Capital’s discreet and tamper-proof packaging ensures the safe arrival of precious metals at their destination. With a strong focus on exceptional customer service and reliable delivery timelines, clients can have peace of mind knowing that their investments are well taken care of.

3. Storage and Maintenance of Precious Metals

Lear Capital offers secure storage solutions for precious metals, providing options for both IRA accounts and physical holding of coins and bars. By emphasizing the safety and upkeep of these assets, Lear Capital aims to give investors seeking dependable storage choices a sense of reassurance.

Investors have the opportunity to utilize Lear Capital’s cutting-edge storage facilities, which feature advanced security measures like round-the-clock surveillance, insurance coverage, and secure transportation services. Opting to store metals in IRA accounts not only delivers tax benefits but also ensures adherence to IRS regulations.

The convenience of physical storage solutions enables investors to conveniently access and manage their assets as needed, granting them flexibility and control over their investment portfolio.

What are the Benefits of Investing with Lear Capital?

Investing with Lear Capital presents a multitude of advantages, such as the potential for robust investment outcomes, high levels of customer contentment, and a solid company standing. Opting for Lear Capital as your investment ally grants individuals access to a variety of benefits that contribute to their financial growth and stability.

By upholding a commitment to financial excellence, Lear Capital has forged a reputation for delivering outstanding returns to its clientele. This proven track record of investment success not only fosters trust but also instills confidence in investors seeking dependable opportunities.

The company’s unwavering dedication to customer satisfaction ensures that clients receive tailored service and assistance at every stage. With Lear Capital, investors can find solace in the knowledge that their financial future is entrusted to capable and trustworthy hands.

1. Diversification of Portfolio

One of the key advantages of investing with Lear Capital is the ability to effectively diversify your portfolio. By investing in precious metals through Lear Capital, investors can reduce risk and improve the stability of their investment accounts, resulting in a well-rounded and resilient financial profile.

This strategic diversification plays a critical role in minimizing the impact of market fluctuations and uncertainties. Throughout history, precious metals like gold and silver have acted as safe-haven assets during periods of economic instability, providing a safeguard against inflation and currency devaluation.

Lear Capital’s expertise in assisting clients with incorporating these assets into their portfolios enables investors to navigate volatile market conditions with confidence.Diversification not only protects against concentration risk but also has the potential to optimize long-term investment outcomes by diversifying returns across different asset classes.

2. Protection Against Inflation and Economic Uncertainty

Investing with Lear Capital offers a valuable hedge against inflation and economic uncertainty, providing a safeguard for investors’ assets in times of market volatility. By incorporating precious metals into their investment portfolios, individuals can not only protect the value of their investments but also maintain financial stability amidst economic challenges.

Throughout history, precious metals such as gold and silver have proven their worth as safe haven assets, preserving wealth when traditional markets face turmoil. In times of economic downturns, these metals have shown resilience and tend to perform well, acting as a shield against declines in stocks and bonds. This resilience aids in diversifying investment portfolios and lowering overall risk exposure.

The inherent value and limited supply of precious metals offer a shield against currency devaluation and fluctuating inflation rates, making them an appealing choice for long-term wealth preservation strategies.

3. Potential for High Returns

Investing with Lear Capital offers the potential for high returns on precious metals investments, giving investors the chance to take advantage of market trends and price fluctuations. Lear Capital focuses on delivering value and satisfaction to clients, aiming to optimize investment returns for its customers.

This strategy is further supported by the historical performance of precious metals such as gold, silver, platinum, and palladium, which have demonstrated resilience and growth over time, making them appealing long-term investment options.

Lear Capital’s knowledgeable advisors keep up-to-date on market dynamics and collaborate closely with clients to develop personalized investment strategies tailored to their financial objectives.

By integrating industry expertise with a dedication to customer-centric service, Lear Capital provides a comprehensive platform for investors looking to diversify their portfolios and potentially achieve substantial returns in the precious metals market.

Protect Your Retirement

Claim Your FREE Gold Kit Now

How Does Lear Capital Compare to Other Precious Metals Companies?

When considering Lear Capital in comparison to other companies specializing in precious metals, several factors are vital to take into account. These include fees charged, customer complaints received, and overall customer feedback.

Alongside assessing these elements, it is important to consider the company’s standing in the industry to enable investors to make well-informed choices when selecting a partner for their precious metals investments.

Lear Capital distinguishes itself within the sector by its proactive approach to addressing customer issues and maintaining open lines of communication. In contrast to certain competitors that may have concealed fees or intricate pricing systems, Lear Capital emphasizes simplicity and transparency regarding its costs.

The company’s commitment to ensuring client satisfaction is demonstrated through its responsive customer service team and dedication to efficiently resolving concerns. Through prioritizing transparency and placing clients’ requirements at the forefront, Lear Capital has cultivated a reputation for dependability and credibility within the precious metals market.

1. Fees and Pricing

When comparing Lear Capital to other companies, one important factor to consider is its fee structure and pricing transparency. Analyzing the fees that Lear Capital charges and comparing them to industry norms can help investors determine the cost-effectiveness of choosing to invest with the company.

Lear Capital aims to stay competitive in the precious metals market by offering a fee structure that is transparent and clear for investors. This transparency enables customers to make well-informed decisions about their investments without encountering hidden costs or unexpected charges.

In contrast to other companies in the same industry, Lear Capital’s pricing policy is often praised for its fairness and affordability, making it an appealing choice for individuals seeking to diversify their portfolios with precious metals. This commitment to competitive pricing highlights Lear Capital’s dedication to delivering value and top-notch service to its clients.

2. Customer Reviews and Reputation

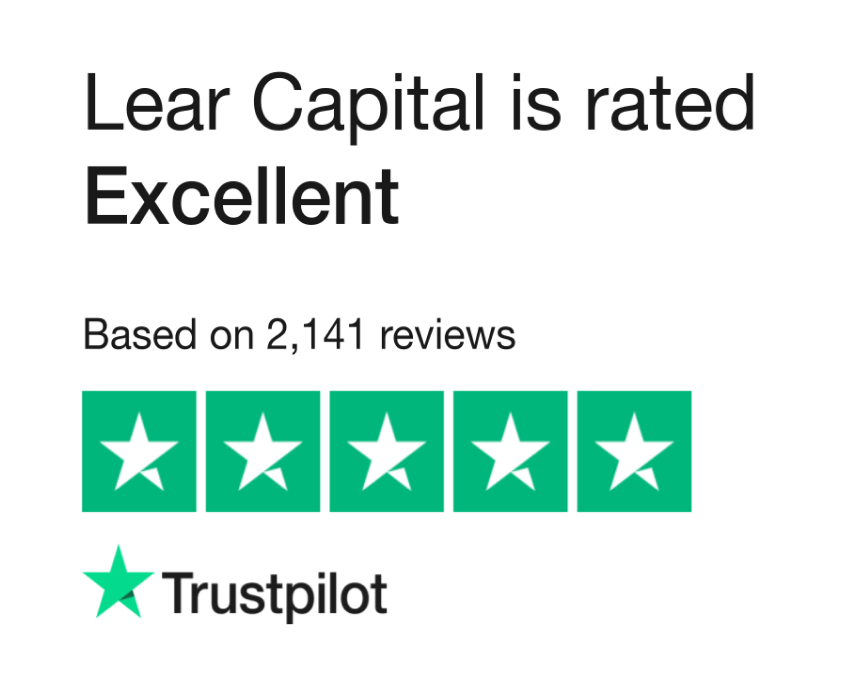

Customer reviews and the overall reputation of Lear Capital offer valuable insights into the company’s performance and customer satisfaction levels.

By exploring reviews on platforms like Trustpilot and assessing the company’s position within the industry, investors can assess the trustworthiness and dependability of Lear Capital as an investment partner.

These reviews provide a window into the experiences of clients who have engaged with Lear Capital, illuminating their levels of satisfaction and the caliber of services received. The company’s dedication to addressing complaints and feedback is apparent in its prompt and effective responses to customer concerns.

Additionally, industry experts recognize Lear Capital’s endeavors to uphold a positive reputation through transparent communication and dependable services. External review platforms like Trustpilot further validate the company’s commitment to customer satisfaction and reinforce its standing as a reputable player in the investment sphere.

3. Products and Services Offered

The extensive range and superior quality of products and services offered by Lear Capital serve as key factors that set the company apart from its competitors. By examining the array of investment choices, features of IRA accounts, and storage options provided by Lear Capital, investors can make well-informed decisions regarding potential collaboration with the company.

Lear Capital provides a diverse selection of investment options, including gold, silver, platinum, and palladium, catering to various investor preferences and financial objectives. This variety enables investors to customize their portfolios based on their risk tolerance and investment goals.

The IRA accounts offered by Lear Capital present tax-advantaged growth opportunities, helping with individuals in safeguarding their retirement funds. Additionally, the company’s storage solutions ensure the protection and security of precious metals investments, offering features like segregated storage and insurance coverage to enhance peace of mind.

Protect Your Retirement

Claim Your FREE Gold Kit Now

Remember to read our list of the Top Gold Companies to see if Lear Capital made the cut.

Or, if you like what you read about Lear Capital, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.