Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Looking to invest in gold? Look no further than Gold Alliance.

This review provides an overview of Gold Alliance, explores their company reputation and ratings, discusses their services and investment options, guides you through getting started with them, and weighs the benefits and drawbacks.

We also compare Gold Alliance to other gold investment companies, discuss associated costs, share consumer feedback, and provide a final verdict. Stay tuned for FAQs about Gold Alliance!

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

Hand picked top 5 trusted and best reviewed companies

Protect Your Retirement

Claim Your FREE Gold Kit Now

Key Takeaways

Overview of Gold Alliance

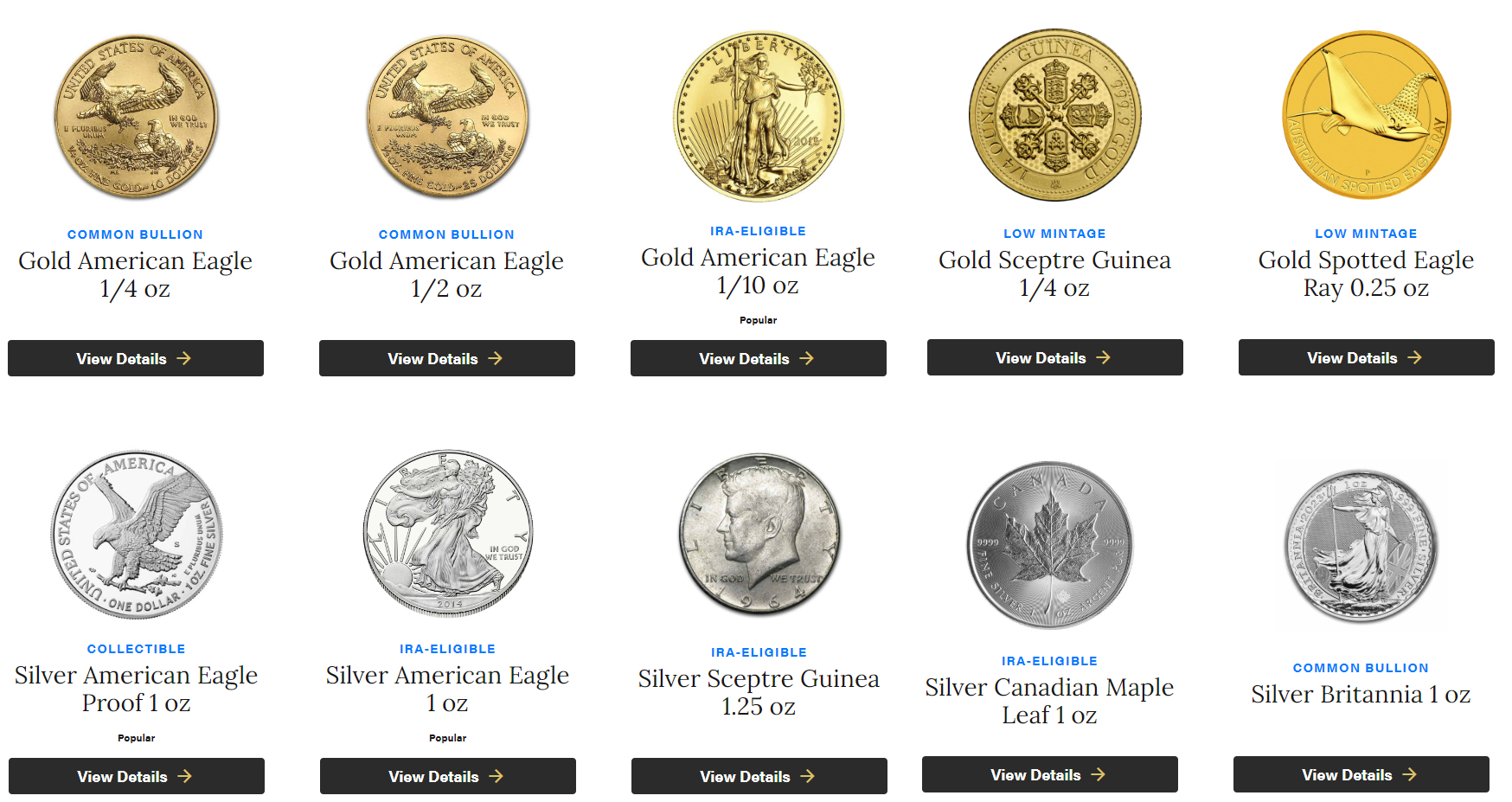

Gold Alliance offers a wide range of precious metal products and services, including coins like the Gold American Eagle.

As a trusted custodian, they provide secure accounts for investors to manage their assets with transparent pricing and educational resources.

Investors have the opportunity to explore a diverse selection of coins at Gold Alliance, such as the Silver Canadian Maple Leaf and the Platinum Australian Kangaroo. With a team of dedicated custodians, the firm ensures that client accounts are safeguarded and meticulously maintained to meet individual investment goals.

The pricing transparency at Gold Alliance allows clients to make informed decisions, knowing the exact costs involved in each transaction. The educational resources provided by Gold Alliance enable investors with valuable insights and knowledge about precious metals and the market trends.

Company Reputation and Ratings

The reputation and ratings of Gold Alliance are important factors for potential investors to consider. By evaluating customer reviews on platforms like Trustpilot and the company’s accreditation with the BBB, individuals can assess the level of trust and satisfaction among clients.

Positive feedback plays a significant role in establishing trust with investors. A solid reputation can attract new clients and retain current ones, leading to sustained success in the long run.

Reviews on Trustpilot provide valuable insights into the customer experience, showcasing Gold Alliance’s dedication to transparency and service excellence. The BBB accreditation adds an extra layer of credibility, providing investors with assurance of the company’s ethical conduct.

Investing in a reputable firm like Gold Alliance not only ensures financial security but also offers peace of mind, knowing that investments are in reliable hands.

Trustpilot Reviews and Ratings

Trustpilot reviews offer valuable insights into the performance of Gold Alliance within the precious metals investment sector. Customers’ feedback on various aspects, such as fees, customer service, and overall satisfaction, can be instrumental in aiding potential investors in making well-informed decisions.

These reviews frequently illuminate the investment experiences that individuals have encountered with Gold Alliance, providing a glimpse into the reliability and credibility of the services offered.

Many reviewers highlight the transparent fee structures provided by Gold Alliance, which play a vital role for investors in assessing the cost-effectiveness of their investments. Positive remarks concerning the exceptional customer service also indicate a significant emphasis on client satisfaction.

Such favorable feedback not only serves to validate the reputation of Gold Alliance but also functions as a magnet, drawing in new clients who are in search of dependable and effective investment opportunities.

Protect Your Retirement

Claim Your FREE Gold Kit Now

Client Reviews & Experience

Client reviews and experiences of Gold Alliance offer valuable insights into the investment process and associated risks. Understanding how investors have experienced products like the Gold American Eagle can help in evaluating the company’s trustworthiness and efficiency.

Customers often express their satisfaction with Gold Alliance’s secure storage options for precious metals such as the Gold American Eagle. Some reviews mention the ease of converting assets into cash when required, demonstrating the versatility of investments with this company.

Feedback on the customer service team’s promptness during market fluctuations also influences investors’ decisions. These perspectives from fellow investors can provide essential guidance for individuals contemplating entering the precious metals market through Gold Alliance.

Understanding Gold Alliance Services

To gain a comprehensive understanding of Gold Alliance’s offerings, one should explore the range of investment services they provide. From overseeing precious metals like the Gold American Eagle to receiving tailored guidance from financial advisors, Gold Alliance strives to address a variety of investment requirements.

The role of their custodians in securely managing investments is pivotal, providing clients with a dependable framework for safeguarding their wealth through physical assets. Alongside the renowned Gold American Eagle, Gold Alliance also presents a selection of other precious metal products, equipping investors with effective options to diversify their investment portfolios.

The financial advisory services provided by Gold Alliance bring a wealth of expertise to clients, assisting them in navigating the intricate realm of investments and making well-informed decisions for their financial future.

Gold Alliance Offerings

Gold Alliance offers a wide variety of precious metals, ranging from traditional bullion to specific coins such as the Gold American Eagle and the Canadian Platinum Maple Leaf. These products are designed to meet the needs of investors seeking to enhance the diversity of their SDIRA portfolios with tangible assets.

Investors value the flexibility of Gold Alliance’s product selection, which includes options like the Gold American Eagle and the Canadian Platinum Maple Leaf that offer both value and variety.

The Gold American Eagle, a popular choice among collectors and investors, represents American heritage and is guaranteed by the US government for its weight and purity.

In contrast, the Canadian Platinum Maple Leaf presents a distinctive investment opportunity for those interested in adding platinum to their portfolio. Both of these coins are well-suited for SDIRA investments due to their steady worth and intrinsic value.

Investment Options with Gold Alliance

Gold Alliance provides a variety of investment options, including IRAs, SDIRAs, and traditional stock and bond markets. By emphasizing precious metals as a viable alternative, investors can diversify their portfolios and protect against market volatility.

When compared to traditional stocks and bonds, investing in precious metals can offer a sense of stability and security. This is particularly important during periods of economic uncertainty, as assets like gold and silver have historically maintained their value.

Through Gold Alliance’s specialized services, individuals can explore the advantages of incorporating precious metals into their investment strategy. This approach ensures a comprehensive method to wealth accumulation and guards against potential risks in the broader financial markets.

Educational Resources and Market Analysis

Gold Alliance offers investors a wide range of educational resources and market analysis to support their decision-making process. Whether it’s understanding pricing dynamics or looking into specific products like the Gold American Eagle, clients can tap into the company’s wealth of expertise.

The company also provides in-depth courses on gold investing, covering diversification strategies and risk management techniques. Through the utilization of advanced market analysis tools available at Gold Alliance, investors can stay abreast of market trends and make informed investment decisions.

The financial advisors associated with Gold Alliance play a pivotal role in navigating clients through the intricacies of the precious metals market. They offer personalized guidance and customized investment plans to assist clients in reaching their financial objectives.

Protect Your Retirement

Claim Your FREE Gold Kit Now

Getting Started with Gold Alliance

Starting your investment journey with Gold Alliance entails the process of opening an account and navigating through the investment procedures. Whether you choose products such as the Gold American Eagle or explore the option of a self-directed individual retirement account (SDIRA), understanding the initial steps is essential.

Commencing with the account opening process at Gold Alliance is simple and easy to follow. You can either visit their website or reach out to their customer service to initiate the procedure. Once your account is established, you can explore the realm of investing in products like the Gold American Eagle.

This renowned coin provides a secure and physical asset to help diversify your investment portfolio. For individuals interested in SDIRAs, creating an account with Gold Alliance involves specific steps to ensure adherence to regulations and the smooth management of your precious metal investments.

Opening an Account

Opening an account with Gold Alliance is a simple process that involves providing personal information and funding your account. It is crucial for new investors to comprehend the pricing structure, fees, and minimum investment requirements, particularly for products like the Gold American Eagle.

After completing the necessary paperwork for setting up the account, you can fund your account using different methods such as wire transfers or checks. Gold Alliance takes pride in its transparent pricing, ensuring that clients are well-informed about the costs and fees associated with their investments.

Before making any investment decisions, it is recommended to carefully review the fee schedule provided by Gold Alliance to clearly understand what to anticipate. For products like the Gold American Eagle, there are specific minimum investment requirements that investors must meet to participate in this opportunity.

Investment Process

The investment process at Gold Alliance involves assessing risks, exploring various investment options, and selecting products like the Gold American Eagle or SDIRAs based on individual financial goals. Understanding this process is crucial for ensuring that investors can make well-informed decisions.

To begin, the process starts with a comprehensive risk assessment, carefully analyzing potential risks associated with different investment options. Subsequently, investors are presented with a range of alternatives tailored to meet their specific financial objectives.

The selection of the appropriate investment product, such as the esteemed Gold American Eagle coins offered by Gold Alliance, plays a critical role in building a diversified portfolio. By aligning investment decisions with financial goals, individuals can effectively secure their financial future.

Benefits and Drawbacks of Gold Alliance

Gold Alliance provides a variety of advantages, ranging from tax benefits in IRAs and SDIRAs to the security offered by physical assets like gold. However, there are also potential drawbacks to consider, including storage costs and market risks associated with investments in precious metals.

Investing in Gold Alliance through IRAs or SDIRAs can offer individuals tax advantages such as the deferral of taxes on profits or the possibility of tax-free withdrawals during retirement. Holding physical gold can act as a safeguard against economic instability and inflation, providing a level of asset protection that may not be present with paper investments.

Nevertheless, investors should take into account the storage expenses linked with owning physical gold and the market volatility that can influence its worth. It is essential to carefully evaluate these pros and cons when choosing between traditional IRAs and self-directed IRAs for gold investments.

Advantages

The benefits of investing with Gold Alliance are plentiful, encompassing tax advantages in IRAs and SDIRAs as well as individualized guidance from financial advisors. Clients have the opportunity to experience the security of tangible assets and the potential for enduring growth in investments in precious metals.

Gold Alliance takes pride in its extensive selection of precious metal choices, enabling clients to effectively diversify their investment portfolios. By incorporating assets like gold, silver, platinum, and palladium, investors can safeguard themselves against market fluctuations and economic instabilities.

The team of seasoned financial advisors at Gold Alliance is committed to assisting clients in navigating the intricacies of investing in precious metals, ensuring that they make well-informed decisions that align with their specific financial objectives. This personalized approach distinguishes Gold Alliance as a reliable partner in the realms of wealth preservation and expansion.

Disadvantages

While Gold Alliance does offer numerous benefits, it is important to consider certain drawbacks, including storage fees for physical assets and the inherent market risks associated with investing in precious metals. A thorough understanding of these disadvantages is crucial for making well-informed decisions.

When investing in physical assets like gold through Gold Alliance, investors should be aware of additional costs beyond the initial purchase price. Storage fees are a notable expense that must be factored in, as they can impact overall returns. Moreover, the prices of precious metals can experience significant fluctuations, exposing investors to market volatility and potential financial losses. To mitigate these risks, implementing effective risk management strategies, such as asset diversification and staying abreast of market trends, is essential.

Regularly assessing the investment portfolio and making necessary adjustments can help investors navigate through market uncertainties and make informed decisions about their investment strategies.

Comparing Gold Alliance to Alternatives

When comparing Gold Alliance to other gold investment companies, factors such as IRA compatibility, SDIRA options, and investment diversity are key considerations. Analyzing how Gold Alliance measures up against other options can assist investors in making informed decisions.

Gold Alliance distinguishes itself in the gold investment sector because of its extensive range of IRA and SDIRA choices. Gold Alliance not only presents conventional IRA investment opportunities in physical gold but also enables self-directed IRAs, granting investors greater autonomy over their precious metal investments.

In contrast to its competitors, Gold Alliance’s wide-ranging investment options cater to a diverse array of investor preferences and risk tolerances, providing a comprehensive solution for those interested in stability and growth within their portfolios.

Comparison with Other Gold Investment Companies

When comparing Gold Alliance with other gold investment companies, it is crucial to take into account factors like ETF availability, custodial services, and investment fees.

Understanding the unique aspects of Gold Alliance’s product offerings and customer service can play a significant role in shaping investment choices.

Gold Alliance sets itself apart by offering a diverse range of ETF options, enabling investors to effectively diversify their portfolios. Additionally, their secure custodial services provide clients with a sense of security by protecting their assets. In terms of investment fees, Gold Alliance maintains a competitive edge by ensuring a transparent fee structure.

By assessing the variety of products available, investors can access a range of gold investment options that cater to their specific requirements. The importance of dependable customer support cannot be underestimated, as it plays a crucial role in enhancing the overall investor experience and satisfaction.

Costs Associated with Gold Alliance

It is essential for investors to have a comprehensive understanding of the costs associated with Gold Alliance, which encompasses pricing structures, service fees, and expenses related to products such as Bullion or the Gold American Eagle. Being aware of these costs is crucial for investors to effectively plan their financial strategies.

Investors should note that Gold Alliance’s pricing model typically involves a premium above the spot price of gold, which can fluctuate based on market conditions. Along with this premium, investors may also be subject to service fees for account maintenance, storage of physical gold, or other administrative tasks.

When evaluating products like Bullion or the Gold American Eagle, investors must take into account factors such as the purchase price, potential shipping costs, and any taxes or duties that may be applicable. To minimize costs within their investment portfolios, investors can implement strategies like diversification, strategic allocation, and regular performance reviews to ensure optimal investment outcomes.

Consumer Feedback and Ratings

Consumer feedback and ratings on platforms like Trustpilot and the BBB provide valuable insights into Gold Alliance’s performance and reputation. Examining customer reviews can assist potential investors in assessing the company’s reliability and level of service.

Positive reviews are pivotal in attracting new clients to Gold Alliance, as they act as endorsements of satisfaction and credibility. By upholding a robust online presence and actively interacting with customers on review platforms, the company can bolster its reputation and establish trust among prospective investors. Swiftly addressing feedback, whether positive or negative, showcases a dedication to customer contentment and transparency, further cementing Gold Alliance’s standing as a reputable and customer-centric investment firm.

Protect Your Retirement

Claim Your FREE Gold Kit Now

FAQs about Gold Alliance

For those individuals looking for more information on Gold Alliance’s services, the FAQs serve as a helpful resource. Covering common questions about products, customer support, and policies, these FAQs aim to offer clear information to clients who are considering investments such as the Gold American Eagle.

One of the frequently asked questions involves the process of buying Gold American Eagles through Gold Alliance. The company provides a simple and clear approach, walking customers through each step of the purchasing process.

Questions regarding the authenticity and purity of the gold coins are often addressed to reassure investors about the quality of their purchases. Another common query revolves around storage options for precious metals obtained through Gold Alliance, with the company offering secure storage solutions to ensure the safety and protection of clients’ investments.

Final Verdict

Final Verdict on Gold Alliance

The evaluation of Gold Alliance ultimately hinges on an analysis of its services, customer satisfaction levels, and overall performance. By taking into account elements such as investment choices, customer reviews, and industry standing, investors can make well-informed decisions regarding potential collaboration with Gold Alliance.

It is apparent that Gold Alliance places significant emphasis on ensuring customer satisfaction by offering a variety of tailored services and investment strategies. The company’s dedication to delivering a personalized experience for clients has led to substantial positive feedback and enduring relationships.

Gold Alliance’s standing in the industry as a dependable and reputable partner further augments its attractiveness to prospective investors. Through a consistent delivery of high-quality service and responsiveness to customer requirements, Gold Alliance has established itself as a respected investment provider with a proven history of success.

Remember to read our list of the Top Gold Companies to see if Gold Alliance made the cut.

Or, if you like what you read about Gold Alliance, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.