Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Are you searching for a reliable investment firm to assist with your financial planning? Fisher Capital Group might be the solution you need. They offer a comprehensive range of services, including investment management, financial planning, retirement planning, tax planning, and estate planning, making them a versatile choice for a wide variety of clients.

In this article, we’ll dive into the services Fisher Capital Group provides, their fees and minimum investment requirements, and the pros and cons of working with them. Let’s take a closer look at what sets Fisher Capital Group apart from other investment firms.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-4)”,”hsl”:{“h”:131,”s”:0.5575,”l”:0.4431}}},”gradients”:[]}}]}__CONFIG_colors_palette__ Click Here to Read Our Top 5 Gold Companies List

Hand picked top 5 trusted and best reviewed companies

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

Key Takeaways

- Fisher Capital Group offers a range of comprehensive financial services, including investment management, financial planning, retirement planning, tax planning, and estate planning.

- With its affordable fees and minimum investment requirements, Fisher Capital Group is a great option for individuals and families of all income levels.

- Fisher Capital Group stands out from other investment firms with its personalized approach, strong customer reviews and ratings, and top-notch safety and security measures.

What Is Fisher Capital Group?

Fisher Capital Group is a renowned financial and investment firm based in California, providing a range of personalized services designed to meet the diverse needs of its clients.

![]()

The company’s expertise in financial planning, investment management, and regulatory compliance has established it as a trusted name in the industry.

Who Is Fisher Capital Group Best Suited For?

Fisher Capital Group is best suited for clients who seek comprehensive financial planning and management services tailored to their individual goals and needs.

With a focus on understanding each client’s unique financial situation, Fisher Capital Group caters to a diverse range of individuals looking to secure their financial future. Whether it’s individuals planning for retirement, managing estates, or seeking tax-efficient investment solutions, the firm’s personalized approach ensures that clients receive customized strategies aligned with their specific objectives.

By offering a collaborative partnership and staying abreast of changing financial landscapes, Fisher Capital Group helps clients navigate complexities and make informed decisions to achieve long-term financial prosperity.

What Are The Services Offered By Fisher Capital Group?

Fisher Capital Group offers a wide range of personalized services, leveraging its expertise to provide comprehensive financial planning, retirement solutions, estate management, and tax efficiency strategies.

Investment Management

The investment management services at Fisher Capital Group are designed to help clients build and manage diversified portfolios that align with their financial goals.

One of the key aspects of our investment management process is portfolio diversification, which involves spreading investments across different asset classes and industries to reduce risk. This strategy helps in optimizing returns while minimizing potential losses.

Plus diversification, our firm focuses on risk management by carefully analyzing the risk tolerance and investment objectives of each client. By understanding individual risk preferences, we can create customized investment strategies that strike a balance between growth potential and risk mitigation.

Financial Planning

Financial planning at Fisher Capital Group involves a comprehensive approach to understanding clients’ financial goals and creating a tailored plan to achieve them.

This process starts with a thorough discussion between the client and the financial planners to identify short-term and long-term objectives.

Goal setting is crucial as it lays the foundation for the entire plan. Once the goals are established, the next step involves a detailed financial analysis of the client’s current situation, including income, expenses, assets, and liabilities. This is where the expertise of Fisher Capital Group’s financial planners shines, as they delve deep into the numbers to uncover opportunities and potential risks.

Retirement Planning

Retirement planning services at Fisher Capital Group include personalized strategies for maximizing retirement savings through IRAs, 401(k)s, and other investment vehicles.

When considering the best retirement planning options, individuals often turn to vehicles like Individual Retirement Accounts (IRAs) and 401(k) plans. These investment tools allow for tax-advantaged growth over time, providing a foundation for a financially stable retirement.

Fisher Capital Group specializes in tailoring these strategies to fit each client’s unique goals and financial situation. By offering personalized guidance and expertise, Fisher Capital Group helps clients navigate the complex world of retirement planning, ensuring a secure future.

Tax Planning

Fisher Capital Group offers tax planning services aimed at enhancing tax efficiency and minimizing liabilities for its clients.

As individuals and businesses navigate the intricate landscape of tax regulations, the importance of strategic tax planning cannot be overstated.

Developing a tax-efficient strategy can lead to significant savings and ensure compliance with the ever-changing tax laws.

The expertise of Fisher Capital Group’s tax planners shines through in their ability to navigate these complexities and tailor solutions that align with each client’s unique financial goals. By staying abreast of the latest tax developments and utilizing their in-depth knowledge, the firm’s professionals provide invaluable guidance in maximizing tax savings and minimizing risks.

Estate Planning

Estate planning services at Fisher Capital Group are designed to help clients manage and transfer their wealth in accordance with their financial goals and wishes.

One of the key components of estate planning is wills, which outline how a person’s assets and properties will be distributed after their passing. At Fisher Capital Group, the team works closely with clients to draft comprehensive wills that reflect their intentions and minimize potential conflicts among beneficiaries.

Another vital aspect is the establishment of trusts, which provide a structured way to manage and safeguard assets for future generations. Through meticulous planning, the firm tailors trust agreements to suit each client’s unique circumstances and protect their legacy.

Asset protection is also paramount in estate planning, ensuring that clients’ wealth is shielded from potential risks and creditors. Fisher Capital Group employs strategies such as asset titling and insurance to safeguard assets and preserve financial security for beneficiaries.

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

What Are The Fees And Minimum Investment Requirements?

Fisher Capital Group’s fees and minimum investment requirements vary depending on the specific services and investment strategies chosen by the client.

For clients opting for wealth management services, Fisher Capital Group typically charges a percentage of assets under management as a fee. This fee structure is commonly referred to as the asset-based fee model, where the client pays a percentage of the total value of their invested assets annually. The percentage may vary based on the total amount being managed.

On the other hand, for clients interested in individual investment advisory services, Fisher Capital Group may charge a flat fee based on the complexity of the financial plan or investment advice provided. This fee structure is more suitable for clients seeking personalized investment guidance without necessarily transferring asset management responsibilities to the firm.

What Are The Pros And Cons Of Working With Fisher Capital Group?

Working with Fisher Capital Group offers several advantages, including personalized services and expert financial planning, but it’s important to also consider potential drawbacks such as fees.

Pros

The pros of working with Fisher Capital Group include personalized services tailored to individual client needs, extensive expertise in financial planning, and strong regulatory compliance.

By offering personalized services, Fisher Capital Group ensures that each client’s unique financial goals and preferences are taken into account, creating a customized strategy that aligns with their specific needs.

The firm’s expert financial planning team is dedicated to providing comprehensive guidance and support, leveraging their wealth of knowledge and experience to help clients make informed decisions and achieve their desired outcomes.

Fisher Capital Group places a strong emphasis on regulatory compliance, adhering to strict standards and protocols to safeguard clients’ assets and maintain trust and integrity in all its dealings.

Cons

The cons of working with Fisher Capital Group may include higher fees and minimum investment requirements that may not be suitable for all investors.

It is important for potential clients to carefully consider these factors before engaging with the firm. Higher fees can eat into potential returns on investments, leading to a lower overall profit margin. Minimum investment requirements may exclude smaller investors who do not meet the specified thresholds.

While Fisher Capital Group may offer premium services, the associated costs could be a deterrent for those with limited funds or for individuals looking to test the waters with a smaller investment amount.

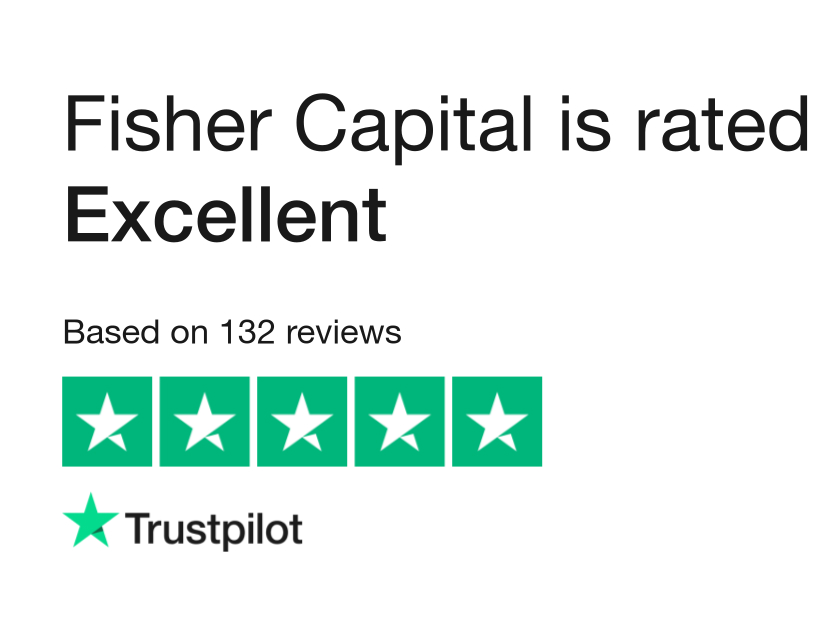

What Are The Customer Reviews And Ratings For Fisher Capital Group?

Customer reviews and ratings for Fisher Capital Group can be found on various platforms, including ConsumerAffairs, where clients share their testimonials and experiences.

The sentiment in the reviews tends to be positive, with many customers praising the personalized service they received from Fisher Capital Group. Clients often highlight the company’s transparency and responsiveness in addressing their financial needs.

A common theme in the feedback is the knowledgeable and professional staff members at Fisher Capital Group who guide customers through the financial planning process. Some reviews also mention the competitive rates offered by the company, which has helped clients achieve their financial goals more efficiently.

How To Get Started With Fisher Capital Group?

Getting started with Fisher Capital Group involves a straightforward process designed to ensure a smooth user experience for new clients.

First, new clients can reach out to Fisher Capital Group to schedule an initial consultation with one of their experienced financial advisors. During this meeting, clients can discuss their financial goals, investment preferences, and risk tolerance.

Following the consultation, Fisher Capital Group will provide personalized recommendations tailored to the client’s specific needs. After reviewing these recommendations, clients can then proceed to select the services that best align with their investment objectives.

What Makes Fisher Capital Group Stand Out From Other Investment Firms?

Fisher Capital Group stands out from other investment firms due to its unique propositions, including personalized expertise, exceptional customer service, and notable achievements and awards.

One of the key factors that sets Fisher Capital Group apart is its unwavering commitment to providing personalized expertise to each client. This personalized approach ensures that every investment strategy is tailored to meet the individual needs and goals of the client, resulting in a more customized and effective financial plan.

Fisher Capital Group’s exceptional customer service is renowned in the industry. The firm goes above and beyond to ensure that clients feel valued and well taken care of, fostering long-lasting relationships built on trust and reliability.

The firm’s impressive track record of achievements and awards further solidifies its position as a leader in the investment realm. With accolades for innovation, performance, and client satisfaction, Fisher Capital Group continuously proves its dedication to excellence in the financial sector.

What Are The Safety And Security Measures In Place At Fisher Capital Group?

Fisher Capital Group employs stringent safety and security measures, adhering to regulatory compliance standards set by the U.S. Securities and Exchange Commission, as well as the USA Patriot Act and Bank Secrecy Act.

Plus regulatory standards, Fisher Capital Group also conducts regular audit reports to ensure the ongoing effectiveness of its safety protocols. By aligning with the U.S. Securities and Exchange Commission guidelines, the firm demonstrates its commitment to transparency and accountability in financial transactions.

Frequently Asked Questions

What services does Fisher Capital Group offer?

Fisher Capital Group offers a wide range of financial services, including investment management, retirement planning, tax planning, and estate planning.

How is Fisher Capital Group rated by clients?

Fisher Capital Group has received overwhelmingly positive reviews from its clients, with many praising their professionalism, knowledge, and personalized approach.

Is Fisher Capital Group a reputable company?

Yes, Fisher Capital Group has a strong reputation in the financial industry and has been recognized as one of the top financial advisory firms in the country.

What sets Fisher Capital Group apart from other financial firms?

Fisher Capital Group sets itself apart through its commitment to personalized and tailored financial solutions for each client, as well as its team of experienced and highly qualified advisors.

Does Fisher Capital Group have any partnerships or affiliations?

Yes, Fisher Capital Group has partnerships and affiliations with leading financial institutions and organizations, allowing them to provide their clients with a wide range of resources and opportunities.

Protect Your RetirementClaim Your FREE Gold Kit Now

__CONFIG_colors_palette__{“active_palette”:0,”config”:{“colors”:{“62516”:{“name”:”Main Accent”,”parent”:-1}},”gradients”:[]},”palettes”:[{“name”:”Default Palette”,”value”:{“colors”:{“62516”:{“val”:”var(–tcb-color-9)”,”hsl”:{“h”:136,”s”:1,”l”:0.33}}},”gradients”:[]}}]}__CONFIG_colors_palette__ CLAIM YOURFREE GOLD KIT NOW

Remember to read our list of the Top Gold Companies to see if Fisher Capital Group made the cut.

>> Click HERE to read our 5 Best Gold IRA Companies list <<

Or, if you like what you read about Fisher Capital Group, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.