Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Are you considering Rosland Capital as your go-to company for investing in precious metals? In this article, we will explore Rosland Capital in-depth, examining the products and services they offer, the range of precious metals available, and the purchasing options they provide.

We'll delve into their reputation, accreditations, customer reviews, and potential risks associated with investing through them. Additionally, we'll compare Rosland Capital with its competitors, highlighting what sets them apart in the market.

Before making any investment decisions with Rosland Capital, it is crucial to consider your investment goals, risk tolerance, and budget.

Let's get started.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

Hand picked top 5 trusted and best reviewed companies

Protect Your Retirement

Claim Your FREE Gold Kit Now

What is Rosland Capital?

You should check out Rosland Capital if you’re an individual investor looking to mix things up with some precious metals in your portfolio. They’re known for specializing in investment options with gold, silver, and more, and they really focus on providing top-notch IRA services.

What makes Rosland Capital stand out is their dedication to going above and beyond with customer service and offering unique investment opportunities. The history of Rosland Capital goes way back to when they first started with a mission to help investors protect and grow their wealth through precious metals.

They’ve earned a solid reputation over the years for being trustworthy and transparent in the world of precious metals investing. What really makes Rosland Capital different is how they take a personalized approach to help clients figure out the ins and outs of investing in gold, silver, and other precious metals for that long-term financial security they’re looking for.

What Products and Services Does Rosland Capital Offer?

Rosland Capital offers you a diverse range of products and services tailored to meet your investment needs. Whether you’re into exquisite coins or looking for personalized investment advice, Rosland Capital makes sure your purchasing experience is smooth and easy when acquiring precious metals.

Their collection features a variety of stunning coins with intricate designs, perfect for both investment and collecting. Aside from coins, Rosland Capital also has pure gold and silver bars for investors who prefer tangible assets of high quality.

If you’re considering bulk purchases, their bullion options provide a secure and flexible way to invest. Their expert representatives are there to help you navigate the investment world, giving you personalized guidance based on your goals and preferences.

What Types of Precious Metals Does Rosland Capital Sell?

When you’re looking to invest in precious metals, Rosland Capital has got you covered with a wide range of options, from gold and silver to platinum, all available in coins, bars, and bullion. Each metal type brings its own unique benefits for expanding your investment portfolio.

Gold has been the tried-and-true choice for investors for ages, thanks to its inherent value and its knack for safeguarding against inflation. Silver, famous for its industrial uses, pulls double duty as a steady store of value that can help balance out your investments.

On the other hand, platinum stands out as one of the rarest and most valuable metals out there, making it a top pick for investors eyeing high-value assets.

By investing in these precious metals through Rosland Capital, you’re setting yourself up to tap into their historical growth and potentially score some impressive capital gains down the line.

What Are the Different Ways to Purchase Precious Metals from Rosland Capital?

You can easily purchase precious metals from Rosland Capital through their user-friendly website or by reaching out to a knowledgeable representative for help. The process is designed to make sure you have all the info you need before you decide to invest.

When you head to Rosland Capital’s website, you’ll find an online purchasing option that lets you browse a wide selection of precious metals, compare prices, and securely make transactions right from your couch.

Plus, the company’s reps are there to give you personalized guidance, answer your questions, offer advice, and give tailored recommendations based on your investment goals and preferences.

By providing access to detailed info and resources on market trends, product specs, and industry insights, Rosland Capital enables you to make well-informed decisions about your precious metal investments.

Protect Your Retirement

Claim Your FREE Gold Kit Now

Is Rosland Capital a Trustworthy Company?

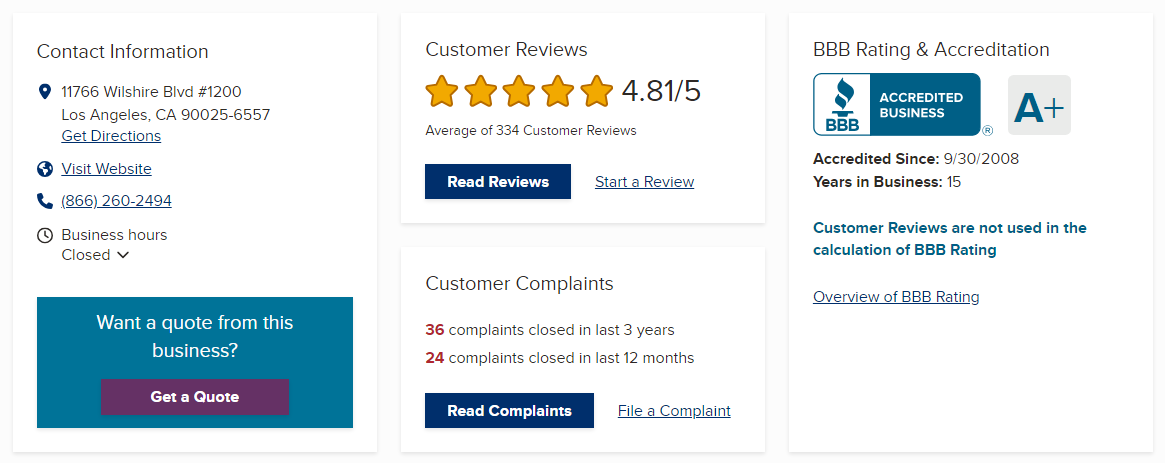

You should consider Rosland Capital if you’re looking for a reliable company in the precious metals industry. They’ve earned accolades like an A+ rating from the Better Business Bureau, showing they’re trustworthy. Rosland Capital is all about following industry rules and making sure they provide top-notch service to their customers.

You can see their commitment to trustworthiness in everything they do. By sticking to strict industry regulations and always delivering reliable service, Rosland Capital builds trust with its clients.

Getting recognized by respected organizations like the Better Business Bureau proves that Rosland Capital is dedicated to excellence. They make transparency a priority in all their transactions, keeping customers well-informed every step of the way. It’s this dedication that solidifies their reputation as a trustworthy player in the precious metals market.

What is the Reputation of Rosland Capital?

You’ll find that Rosland Capital has quite the sterling reputation in the investment community. Customers can’t help but sing praises about the perks of their services and the top-notch quality of their products. The positive reviews greatly outnumber any complaints, showing just how committed the company is to providing you with an exceptional investment experience.

Clients like yourself are always raving about Rosland Capital’s clear-cut pricing, super knowledgeable staff, and secure storage options. These are the things that keep you satisfied. Many investors have even gushed about the impressive returns and peace of mind they’ve gotten from Rosland’s range of investment options.

The company’s dedication to making sure you’re happy is clear in their quick customer support and their focus on teaching you all about the precious metals market. With Rosland’s solid reputation and trustworthiness, it’s no wonder they’re a go-to choice for people looking for reliable investment opportunities.

Is Rosland Capital Accredited by Any Organizations?

You should know that Rosland Capital proudly holds an A+ accreditation from the Better Business Bureau. This accreditation is a reflection of the company’s dedication to excellence and top-notch customer service. When you choose to work with Rosland Capital for your investment needs, you can expect to reap the benefits of this accreditation.

Having that A+ accreditation from the Better Business Bureau means that Rosland Capital upholds high standards of quality assurance. This gives you peace of mind, knowing that you’re dealing with a reputable and dependable company. Opting for an accredited company like Rosland Capital ensures that your investments are safe and that you’ll receive exceptional service every step of the way.

This accreditation also underscores Rosland Capital’s commitment to transparency, ethical business practices, and customer satisfaction, solidifying its reputation as a reliable partner in the precious metals industry.

What Are the Customer Reviews for Rosland Capital?

If you’ve engaged with Rosland Capital, you’ve probably experienced their top-notch customer service and had a positive investment journey. People who’ve dealt with them highly recommend the company for their professionalism and dedication to making customers happy. Those glowing reviews speak volumes about how much customers value Rosland Capital.

A lot of clients have spoken highly of Rosland Capital’s staff, praising them for making the complicated world of investing in precious metals seem like a walk in the park. They go the extra mile to ensure your investment journey is smooth and profitable.

The testimonials often mention the personalized attention each client receives, creating a strong sense of trust and dependability. Customers also love the clear communication and quick responses from Rosland Capital, proving they’re a reputable and customer-focused player in the precious metals industry.

What Are the Risks of Investing in Precious Metals with Rosland Capital?

When you’re looking into investing in precious metals, you need to keep an eye out for potential risks like market fluctuations, fees, and commissions that come with the territory. Rosland Capital wants to make sure you have all the info you need to make smart choices.

Market ups and downs can really shake things up when you’re investing in precious metals through Rosland Capital. The prices of these assets can take unexpected turns, so you’ve got to be prepared.

Don’t forget about the fees and commissions that Rosland Capital charges – they can eat into your investment returns. The good news is that Rosland Capital is all about being upfront with these costs, so you know exactly what you’re getting into.

By understanding these risks from the get-go, you’ll be better equipped to handle the ins and outs of investing in precious metals. That way, you can make decisions that line up with your financial goals.

Are There Any Alternatives to Rosland Capital for Investing in Precious Metals?

When you’re looking for investment opportunities in precious metals, Rosland Capital is a great option. But hey, there are other companies out there offering similar products and services. Checking out what these competitors have to offer in terms of pricing, options, and benefits can really help you make smart choices.

Take a closer look at Rosland Capital and its competitors, and you might spot some variations in how they price things. Some companies might have lower premiums or waive fees for certain investment amounts. And when it comes to investment options, each company might have its own specialty in different types of precious metals or cool storage solutions.

The perks these competitors offer could be anything from flexible buyback programs to custom investment strategies. Exploring these alternatives is key to finding the perfect investment fit that matches up with your financial goals and personal preferences.

What Other Companies Offer Similar Products and Services as Rosland Capital?

If you’re in the market for diversifying your portfolio with precious metals, you’ll find several companies out there offering products and services just like Rosland Capital. These competitors give investors plenty of options to think about when deciding where to put their money.

Take Goldco, for instance. They specialize in gold and silver IRAs, providing a secure way for you to diversify your retirement savings. Then there’s Birch Gold Group, known for their personalized service that guides investors through the process of acquiring precious metals such as gold, silver, platinum, and palladium. And let’s not forget Augusta Precious Metals, who really focus on educating and being transparent with clients to help them make informed decisions about investing in gold and other precious metals.

What Are the Key Differences Between Rosland Capital and its Competitors?

When you look at Rosland Capital compared to other players in the precious metals market, you’ll notice some similarities. But what really makes Rosland Capital shine are its unique offerings, personalized advice, and top-notch customer service. These differences are what truly make Rosland Capital stand out from the competition.

One thing that really sets Rosland Capital apart is its focus on giving you personalized recommendations that match your specific investment goals and risk tolerance. With this level of tailored service, you’re guaranteed expert advice to help you navigate your investment choices.

Rosland Capital doesn’t stop there – they also provide a variety of exclusive investment options, like rare coins and specialty metal products, so you can diversify your portfolio with one-of-a-kind assets. And let’s not forget about their exceptional customer service, which cements Rosland Capital’s reputation as a go-to partner in the precious metals industry.

What Are the Steps to Take Before Investing with Rosland Capital?

Before you dive into investing with Rosland Capital, take a moment to think about your investment goals, how much risk you’re comfortable with, and the budget you have for putting money into precious metals. Knowing these things will help you make smart choices that line up with what you want to achieve financially.

Start by looking at both your long-term and short-term investment goals to figure out why you’re investing and for how long. Also, think about how okay you are with the precious metals market going up and down – that’s your risk tolerance level.

Don’t forget to check out your budget and see how much you can comfortably set aside for metal investments. Once you’ve got a good grip on these factors, think about spreading your investments out to lower the risk and get the most out of your money.

Make sure your investment plan fits your needs, whether you’re into physical metals or other investment options. By following these steps, you can set up a solid investment plan with Rosland Capital that’s tailored just for you.

What is Your Investment Goal?

When you’re getting ready to invest with Rosland Capital, the first thing you need to do is figure out what you want to achieve with your investments. Knowing your investment goals will help create a personalized strategy that fits your financial aims.

By clearly defining your investment goals, you’ll map out your financial journey and steer your decisions towards securing the future you want. Rosland Capital understands that everyone has their own unique objectives and collaborates with clients to set specific milestones and timelines that match their goals.

This partnership approach ensures that each investment plan is tailored to meet your expectations and deliver the outcomes you’re looking for. With a focus on being transparent and providing customized solutions, Rosland Capital gives you the tools to take charge of your financial growth and set yourself up for future success.

What is Your Risk Tolerance?

Before you invest with Rosland Capital, it’s important to assess your risk tolerance. Your risk tolerance determines how comfortable you are with the level of risk involved in your investment choices. Understanding your risk tolerance is crucial because it helps you choose investment options that match your comfort level.

This understanding is key when developing a comprehensive investment strategy that considers both potential returns and risks. Rosland Capital stresses the importance of being transparent about these risks with potential investors.

This ensures that you have a clear understanding of the potential downsides. By evaluating investment options based on your risk tolerance, you can customize your strategies to find a balance that suits your preferences. This personalized approach increases the likelihood of reaching your long-term financial goals while effectively managing risks.

What is Your Budget for Investing?

Establishing a clear budget for investing with Rosland Capital is crucial for making sure you’re managing your funds effectively, keeping fees in check, and planning your investments wisely. When you set your budget early on, you can make smart choices that align with your financial situation.

By setting your budget, you can determine how much you’re comfortable investing and avoid financial overcommitment. This approach lets you prioritize your investments based on your finances and long-term goals.

It’s important to manage fees carefully to maximize your returns, as high fees can eat into your investment profits. With some strategic planning, you can allocate your funds wisely across different asset classes to create a well-rounded portfolio, spreading out risk and maximizing potential gains.

Just keep in mind, effective budgeting and decision-making are key to getting the most out of your investments in the long run.

Protect Your Retirement

Claim Your FREE Gold Kit Now

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.