Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Curious about Oxford Gold Group? This article will provide you with all the information you need to know about this company. From how it works to the products it offers, the benefits and risks of investing with Oxford Gold Group, and even reviews and ratings.

Whether you are considering diversifying your assets, protecting against inflation, or simply looking for high returns, Oxford Gold Group may have the solutions you are looking for. Keep reading to learn more!

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

Hand picked top 5 trusted and best reviewed companies

Protect Your Retirement

Claim Your FREE Gold Kit Now

What is Oxford Gold Group?

The Oxford Gold Group, a trusted company located in Beverly Hills, CA, specializes in aiding individuals in securing their financial future through investments in precious metals. They provide expert guidance on establishing precious metals IRAs to diversify investment portfolios and shield against market uncertainties.

The team of seasoned professionals at Oxford Gold Group helps clients comprehend the advantages of investing in assets such as gold, silver, and platinum, known historically to be a safe haven during economic downturns.

By integrating precious metals into their investment strategy, clients not only diversify their portfolios but also have the opportunity to protect their wealth against inflation and currency fluctuations.

Oxford Gold Group places a strong emphasis on transparency and education, ensuring that each client is well-informed and give the power toed to make informed financial decisions that align with their long-term objectives.

How Does Oxford Gold Group Work?

The Oxford Gold Group functions by leading clients through a transparent process to secure their financial future. They offer step-by-step guidance on investing in precious metals, ensuring security and transparency throughout the entire investment process.

Clients at the Oxford Gold Group receive the benefit of working with dedicated professionals who aid in evaluating individual financial objectives to create a personalized investment strategy. By comprehending each client’s unique goals and risk tolerance, the company suggests a diversified portfolio of precious metals to enhance returns and lessen potential risks.

Through regular updates and market insights, clients are equipped to make informed decisions and adjust their investments in response to changing market conditions, ensuring a proactive approach to wealth preservation and growth.

What Are the Products Offered by Oxford Gold Group?

Oxford Gold Group provides a variety of products, such as platinum and palladium, along with secure storage solutions for clients to protect their investments. Their fee structures are transparent to ensure customers have full visibility of all related costs.

For investors seeking to diversify their portfolios, Oxford Gold Group’s platinum and palladium investment options can be advantageous as they offer a unique hedge against economic uncertainty. With storage facilities in strategic locations that are secure, clients can be assured that their precious metals are stored safely.

The company offers flexible storage options, including allocated and segregated storage, allowing customers to select the approach that best suits their requirements. Regarding fees, Oxford Gold Group prides itself on clear fee structures without any hidden charges, ensuring that clients have a complete understanding of the costs associated with safeguarding their investments.

Protect Your Retirement

Claim Your FREE Gold Kit Now

1. Gold and Silver Bullion

Oxford Gold Group provides a range of gold and silver bullion options for investors seeking to broaden their investment portfolios. These precious metals offer the advantage of easy liquidity, allowing investors the flexibility to convert them into cash when required.

Gold and silver bullion are considered secure tangible assets that can serve as a hedge against economic uncertainties and market fluctuations. By holding physical bullion, investors have direct control and ownership of their assets, decreasing reliance on financial institutions.

The inherent value and limited supply of these metals often lead to sustained value over the long term, establishing them as reliable stores of wealth. Diversifying with gold and silver bullion not only strengthens portfolio resilience but also offers protection against inflation and currency devaluation.

2. Gold and Silver IRAs

Oxford Gold Group offers support to clients in establishing gold and silver IRAs, facilitating the transfer of existing 401(k) or retirement funds. They collaborate with reputable custodians such as Equity Trust to guarantee seamless and secure transactions.

Partnering with Oxford Gold Group not only streamlines the process of diversifying your investment portfolio with precious metals but also ensures the reliability of working with respected custodians like Equity Trust. These custodians play a critical role in efficiently managing your gold and silver IRA accounts, ensuring that your investments are securely held and compliant with IRS regulations.

By relying on experienced professionals like the team at Oxford Gold Group to oversee your retirement savings, you can access the stability and growth potential that investing in physical gold and silver assets offers.

3. Numismatic Coins

Oxford Gold Group presents a range of numismatic coins tailored for collectors and investors interested in acquiring rare and historically significant pieces. The company furnishes clients with valuable market insights to aid them in making well-informed choices regarding their numismatic coin investments.

These specialized coins boast substantial historical and numismatic worth, rendering them not just a distinctive investment opportunity but also desirable collectibles for enthusiasts. Numismatic coins carry a rich sense of history and artisanship, often providing a window into various eras and civilizations.

Investors are captivated by the scarcity and elegance of these coins, which have the potential to appreciate in value over time. Oxford Gold Group comprehends the complexities of this market and assists clients in constructing diversified portfolios through strategic coin acquisitions.

What Are the Benefits of Investing with Oxford Gold Group?

Investing with Oxford Gold Group provides a multitude of advantages, including asset diversification, protection against inflation, and the potential for lucrative returns. Clients can secure their financial future by partnering with a reputable and seasoned organization.

Through Oxford Gold Group’s specialized knowledge, clients have access to a broad array of precious metals, enabling them to build a well-rounded investment portfolio capable of withstanding market fluctuations. By diversifying their portfolio with tangible assets such as gold and silver, investors can mitigate risk and bolster stability within their overall financial strategy.

Precious metals have a proven history of acting as a safeguard against inflation, safeguarding purchasing power even in volatile economic climates. The dedicated team at Oxford Gold Group is committed to assisting clients in reaching their financial objectives, offering tailored solutions that cater to each individual’s unique requirements.

1. Diversification of Assets

The significance of diversifying assets to align with clients’ financial objectives is highlighted by Oxford Gold Group. By allocating investments across various asset classes, individuals can effectively manage risk and improve the stability of their portfolios.

This approach not only aids in lessening the impact of potential losses from any single investment but also presents the potential for growth across different market cycles. Asset diversification stands out as a fundamental principle in the realm of investment management, enabling clients to capitalize on diverse opportunities while minimizing overall risk.

The experienced advisors at Oxford Gold Group collaborate closely with clients to customize portfolios that match their specific goals and risk tolerance levels, ensuring a comprehensive strategy for wealth accumulation and preservation.

Protect Your Retirement

Claim Your FREE Gold Kit Now

2. Protection Against Inflation

Investing with the Oxford Gold Group offers a secure hedge against inflation, ensuring the preservation of the real value of assets over time. Throughout history, precious metals like gold and silver have consistently demonstrated their effectiveness as inflation hedges.

In times of economic uncertainty, particularly periods marked by high inflation, gold and silver have shown their ability to either maintain or increase in value. This characteristic makes them dependable stores of wealth. For instance, during the 1970s when inflation rates surged in the United States, the price of gold experienced a significant increase, surpassing the performance of traditional assets.

Similarly, silver also demonstrated resilience during times of inflation. These historical instances highlight the enduring reliability of precious metals as a method of safeguarding wealth during turbulent economic conditions.

3. Potential for High Returns

Clients who partner with Oxford Gold Group stand to benefit from potential high returns on their investments, thanks to the company’s expertise and deep understanding of the market. By following their expert guidance, clients can seize lucrative market opportunities to yield profitable returns.

At Oxford Gold Group, the team prides itself on staying well-informed about market trends, offering clients valuable insights and personalized investment strategies. Their emphasis on diversified portfolios has proven to be successful, with clients experiencing substantial growth and stability in their precious metals assets.

By meticulously analyzing historical data and predicting market shifts, Oxford Gold Group assists clients in navigating the intricacies of the precious metals market, thereby increasing the likelihood of optimizing returns on their investments.

What Are the Risks of Investing with Oxford Gold Group?

Investing with Oxford Gold Group can offer significant advantages, but it is essential to carefully consider the associated risks, which include market fluctuations and counterparty risk. Understanding these risks is vital in order to make well-informed investment choices.

Market fluctuations present a notable challenge, as the value of gold can fluctuate based on economic conditions and geopolitical events. Counterparty risk arises when dealing with entities that may fail to fulfill their obligations.

To address these risks, clients have the option to diversify their investment portfolio by spreading their funds across a variety of assets. It is also advisable for clients to stay informed about market trends and to seek guidance from financial professionals. By implementing a strategic investment strategy, investors can reduce the likelihood of potential losses and increase the overall security of their gold investments.

1. Market Fluctuations

Fluctuations in the market can have an impact on the value of investments in precious metals with Oxford Gold Group. It is crucial for investors to anticipate volatility and establish a strategy for liquidation to effectively handle uncertainties in the market.

Diversification plays a significant role in navigating market volatility when it comes to investing in precious metals. By allocating investments across a range of precious metals such as gold, silver, platinum, and palladium, investors can reduce risks associated with fluctuations in any one metal.

Remaining informed about global economic conditions, geopolitical events, and monetary policies can offer valuable insights for making well-informed investment choices. By maintaining a long-term outlook and concentrating on the fundamental value of precious metals, investors can withstand short-term fluctuations and position themselves for potential long-term growth.

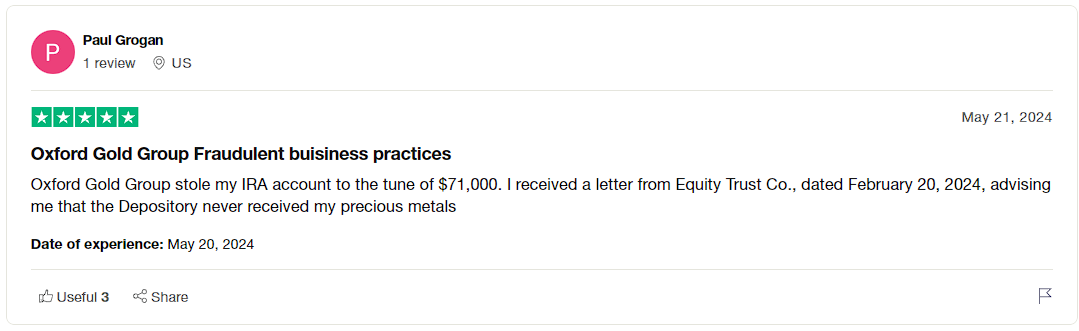

2. Counterparty Risk

The potential danger of a default by a third party engaged in transactions with Oxford Gold Group is known as counterparty risk. Understanding and addressing this risk is crucial to protect investments and ensure the timely delivery of assets.

This risk is especially pertinent in investments related to precious metals, where the physical delivery of the asset holds significant importance. To effectively mitigate counterparty risk, Oxford Gold Group employs various strategies. These include conducting thorough due diligence on all transaction parties, utilizing secure storage facilities, and implementing rigorous verification procedures.

By reducing dependence on third parties and emphasizing direct ownership, the company bolsters the security of client assets. Clients can find reassurance in knowing that their investments are shielded against counterparty risks.

What Are the Fees and Expenses Associated with Oxford Gold Group?

Individuals who choose to work with Oxford Gold Group should take into consideration the fees and expenses associated with the services provided, which include annual fees for the maintenance of investment accounts. It is imperative for clients to have a solid grasp of the fee structures in order to accurately assess the overall cost of their investments.

Apart from the annual maintenance fees, clients must also take into account storage costs, which play a vital role in the ownership of physical gold within their investment portfolios. The amount and type of gold being stored can influence these storage fees, with larger quantities typically incurring higher costs.

Clients are advised to consider these expenses when making investment decisions to ensure they have a comprehensive understanding of the financial implications of their choices.

Is Oxford Gold Group a Legitimate Company?

The Oxford Gold Group is a reputable and credible company known for its commitment to transparency and customer satisfaction. It has earned favorable ratings from the Better Business Bureau and makes its business details easily accessible for clients to peruse.

This trust in the Oxford Gold Group is further reinforced by its consistent adherence to ethical business practices and its dedication to offering customers personalized service. Clients value the clear and comprehensive information that the company provides, enabling them to make well-informed decisions regarding their investments. The company’s esteemed reputation in the industry underscores its credibility and dedication to delivering value to its clients.

Through its emphasis on cultivating enduring relationships founded on trust and dependability, the Oxford Gold Group remains a favored option for investors seeking a reputable partner.

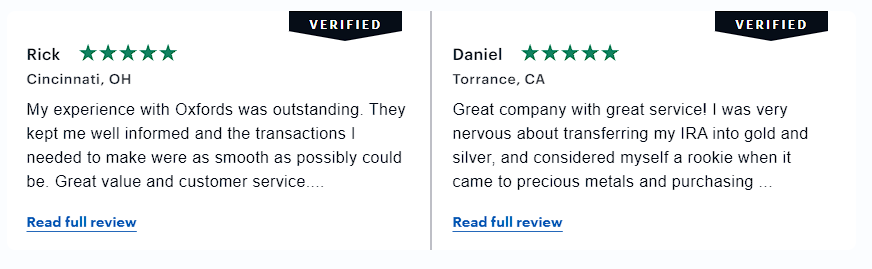

What Are the Reviews and Ratings for Oxford Gold Group?

The customer reviews and ratings for Oxford Gold Group suggest that clients are highly satisfied with the services and expertise provided. While there may be occasional complaints, the general consensus towards the company is positive.

Numerous clients have expressed gratitude for the personalized approach that Oxford Gold Group takes in assisting them with investment decisions.

Customers often praise the knowledgeable and amiable staff members who help them navigate through the process, simplifying complex financial concepts.

Additionally, some reviewers commend the prompt delivery of purchases and the transparent pricing policies. A few customers have raised concerns about communication delays in specific instances, although these seem to be isolated cases. Oxford Gold Group appears to prioritize customer satisfaction, resulting in a majority of positive reviews.

How Can I Contact Oxford Gold Group?

One can easily contact Oxford Gold Group’s customer service team for assistance or inquiries regarding investments in precious metals. The company offers various contact channels to ensure efficient and timely customer support.

This includes a dedicated phone line staffed with knowledgeable representatives who are available to address any questions or concerns. Should you prefer a written record of your communication, you can reach out to the customer service team via email. For immediate assistance, the live chat feature on the company’s website enables real-time interactions with support staff.

If a more personalized approach is desired, scheduling a one-on-one consultation with an investment advisor is also available to receive guidance tailored to specific needs.

Remember to read our list of the Top Gold Companies to see if Oxford Gold Group made the cut.

Or, if you like what you read about Oxford Gold Group, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.