Disclaimer: The companies mentioned in this report may offer compensation to us, without any charge to our readers. This is how we keep our reporting free for readers. Our selection of companies is determined by compensation and rigorous analysis.

Curious about Noble Gold and how it can benefit your investment portfolio? In this comprehensive review, we’ll explore what Noble Gold is, how it works, and why you should consider investing in precious metals.

Discover the advantages of investing in gold, silver, platinum, and palladium, and learn about the different types of precious metals offered by Noble Gold. Find out how you can invest with Noble Gold, the risks involved, and what customers have to say about their experiences.

Our team has spent years researching every company in the precious metals industry. Save your time and use our research ⟶

Hand picked top 5 trusted and best reviewed companies

Protect Your Retirement

Claim Your FREE Gold Kit Now

What is Noble Gold?

Noble Gold is a well-regarded company that specializes in Gold IRAs and investments in precious metals. Known for its emphasis on secure storage options and exceptional customer service, Noble Gold has received favorable reviews from pleased customers.

Founded by Collin Plume and Charles Thorngren, Noble Gold has become a respected name in the industry.

The company’s core philosophy centers around transparency and prioritizing clients’ financial goals. Plus assisting clients in diversifying their investment portfolios with precious metals, Noble Gold also provides education on the complexities of Gold IRAs.

The team of experts at Noble Gold delivers personalized support, ensuring that each client receives customized solutions tailored to their individual needs and investment objectives. This commitment to customer satisfaction has established Noble Gold as a reputable and professional entity in the financial sector.

How Does Noble Gold Work?

Noble Gold assists individuals in establishing Gold IRAs, providing secure storage facilities for precious metals, transparent fee structures, and acting as a dependable IRA provider for those seeking to broaden their asset portfolio.

When investing in a Gold IRA through Noble Gold, the process is simple and effective. They offer various storage options, including segregated storage, where your precious metals are stored separately from others to ensure maximum security and easy tracking.

Additionally, Noble Gold boasts a competitive fee structure with no hidden expenses, making it straightforward for investors to comprehend the costs involved. With a minimum investment requirement that is accessible to many, individuals can easily begin diversifying their investment portfolios. Furthermore, Noble Gold offers buyback programs, offering a smooth exit strategy if necessary.

Why Should You Consider Investing in Noble Gold?

Investing in Noble Gold presents a variety of options, including rare coins, Royal Survival Packs, and a range of bullion products, which makes it a compelling choice for individuals interested in physical assets. What sets the company apart in the industry is its unwavering dedication to customer satisfaction and education.

Noble Gold’s emphasis on ensuring that clients are well-informed and equipped to make informed investment choices is evident through their educational materials and personalized guidance. Alongside offering a diverse array of precious metals, the company’s team of experts is committed to delivering excellent customer service and support.

This comprehensive approach not only assists clients in constructing a robust portfolio but also fosters a trustworthy and enduring relationship between the company and its investors.

Protect Your Retirement

Claim Your FREE Gold Kit Now

What Are the Advantages of Investing in Precious Metals?

Investing in precious metals such as gold and silver presents various advantages, including hedging against economic uncertainty, the potential for price appreciation, and the security of physical assets stored in reputable facilities with insurance coverage.

A significant benefit of investing in precious metals lies in the price stability they offer. Unlike many other assets that can experience substantial fluctuations, precious metals like gold and silver often maintain their value over time. This stability can offer investors a sense of reassurance, knowing that their investments are less susceptible to market volatility.

Furthermore, holding precious metals can function as a form of insurance protection against inflation and currency devaluation, effectively preserving wealth in the long term. The role of secure storage facilities is vital in safeguarding these assets, ensuring their physical security and providing investors with peace of mind. Through portfolio diversification with precious metals, individuals have the potential to enjoy long-term value appreciation and strong returns on their investments.

What Sets Noble Gold Apart from Other Gold Investment Companies?

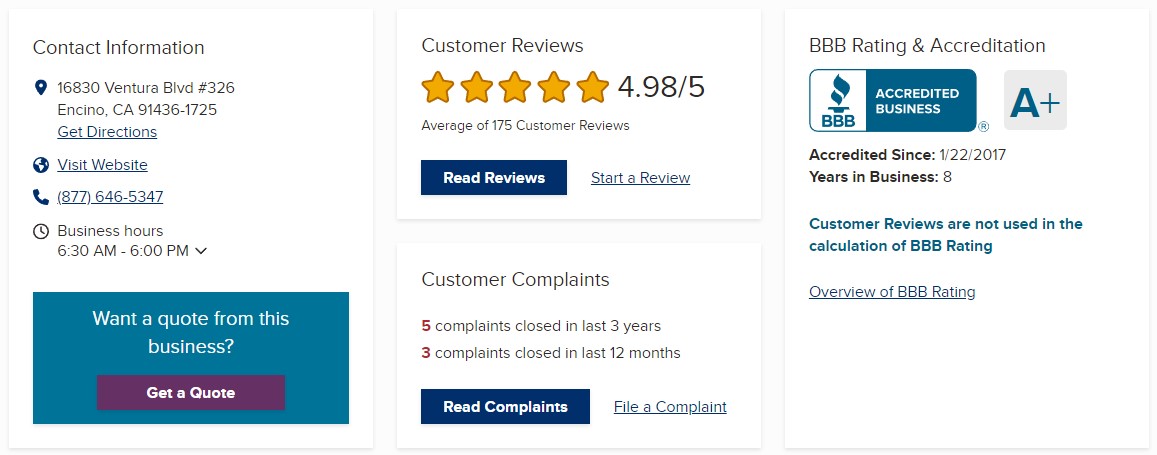

Noble Gold distinguishes itself from other gold investment companies through its dedication to transparency in pricing, exceptional customer service, and high ratings, notably receiving an A+ rating from the Better Business Bureau.

This transparent pricing structure give the power tos customers to make well-informed decisions without encountering hidden fees or unexpected charges. The exceptional customer service provided by Noble Gold exceeds expectations, offering comprehensive assistance to clients at every stage, whether it involves clarifying investment options or extending continual support.

These attributes have garnered Noble Gold recognition from respected organizations such as the BBB, solidifying its reputation as a dependable and trustworthy entity within the gold investment sector.

Numerous customer reviews and testimonials extol Noble Gold’s unwavering commitment to customer satisfaction, emphasizing their professionalism, integrity, and tailored approach to meeting each client’s distinct requirements.

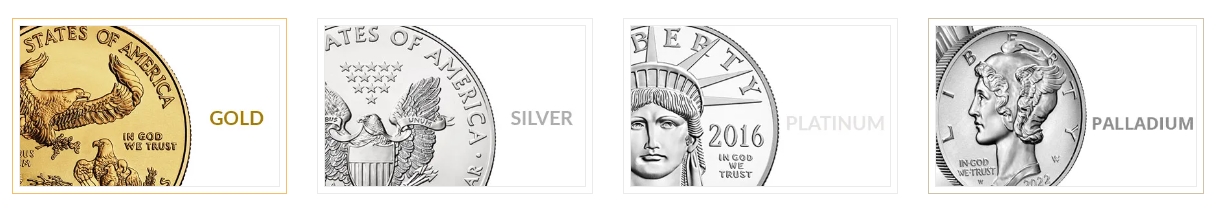

What Are the Different Types of Precious Metals Offered by Noble Gold?

Noble Gold presents an array of precious metals, encompassing platinum, palladium, rare coins, and exclusive Royal Survival Packs, which furnish investors with a wide selection for constructing a comprehensive portfolio.

Investors seeking to broaden and vary their investment portfolio frequently explore precious metals as a steady and dependable choice. Rare coins, whether historical pieces or limited mint editions, introduce a distinctive touch to a collection, appealing to both investors and collectors.

The Royal Survival Packs, meticulously assembled by Noble Gold, consist of a blend of precious metals, furnishing a tangible asset that can withstand economic uncertainties. By spreading investments across various metals, investors can safeguard against market fluctuations and conserve wealth over the long haul.

What Are the Benefits of Investing in Gold?

Investing in gold, such as American Gold Eagles and Canadian Gold Maple Leafs offered by Noble Gold, offers a secure asset that acts as a safe-haven, protects against inflation, and serves as a tangible store of value during times of economic uncertainty.

Gold has a long-standing history of retaining its value across centuries, establishing itself as a reliable choice for many investors. With its limited availability and widespread acceptance, gold coins like American Gold Eagles and Canadian Gold Maple Leafs provide both intrinsic value and the potential for capital growth.

In times of economic turmoil, gold typically performs well by serving as a safeguard against market fluctuations and currency devaluation. Possessing physical gold coins gives investors a sense of assurance, as they hold a tangible asset that will hold its value even in challenging economic circumstances.

What Are the Benefits of Investing in Silver?

Silver investments, such as the Australian Gold Kangaroo, provide diversification, potential for growth, and affordability compared to other precious metals, making them appealing to investors aiming for a well-rounded portfolio.

Investing in silver can serve as a safeguard against inflation and economic instability. Silver’s industrial value further enhances its appeal, extending its demand beyond being just a store of value. Various factors, including supply and demand dynamics, geopolitical tensions, and the broader economic outlook, play roles in determining silver prices.

The Australian Gold Kangaroo coin, recognized for its high purity and exquisite design, stands out as a favored option among investors interested in incorporating silver assets into their investment portfolios.

What Are the Benefits of Investing in Platinum?

Investing in platinum, such as products from Pamp Suisse, can provide a unique opportunity to diversify your portfolio, potentially yielding high returns, and offering access to a rare and valuable metal through secure depositories.

Platinum, renowned for its scarcity and diverse industrial applications, has become increasingly popular among investors seeking to expand their portfolios beyond traditional assets. Given its stable intrinsic value, platinum presents solid prospects for long-term growth, making it an appealing choice for those looking to protect themselves against market volatility.

Ensuring the secure storage of platinum is essential to safeguard your investment, and reputable depositories like Pamp Suisse offer assurance through their cutting-edge facilities and rigorous security protocols.

What Are the Benefits of Investing in Palladium?

Investing in palladium, a global commodity, provides investors with exposure to international markets, the potential for capital appreciation, and the opportunity to diversify portfolios with Trustlink-endorsed products like palladium coins.

The appeal of palladium stems from its wide range of industrial applications, spanning from automotive catalysts to electronics manufacturing. This versatility creates strong demand across various sectors. The metal’s scarcity and unique properties make it an attractive alternative investment, particularly during periods of economic uncertainty.

Trustlink, renowned for its stringent product standards and dependable financial services, plays a crucial role in ensuring the authenticity and quality of palladium products. By integrating palladium into their investment strategy, individuals can shield their wealth against market fluctuations and capitalize on the potential long-term growth of this precious metal.

Protect Your Retirement

Claim Your FREE Gold Kit Now

How Can You Invest in Noble Gold?

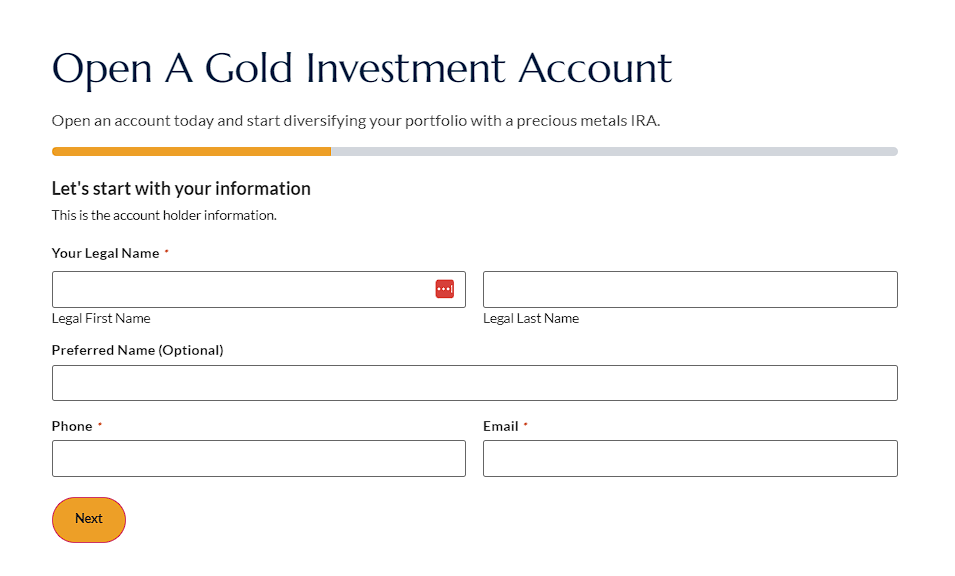

Investing in Noble Gold offers a simple and convenient process, providing a range of investment options, account setup procedures, and opportunities for international investors to diversify their portfolios through physical assets stored in secure depositories.

Those considering investing with Noble Gold can choose from a variety of precious metals such as gold, silver, platinum, and palladium. The account opening process is smooth and straightforward, often completed online or with the assistance of dedicated representatives.

International investors can take advantage of Noble Gold’s global presence, allowing them to securely store their investments in reputable depositories. This feature is essential as it guarantees the safety and security of physical assets, granting investors a sense of reassurance during uncertain economic conditions.

What Are the Different Investment Options Available?

Noble Gold provides a variety of investment options, which include self-directed IRAs that are facilitated in partnership with reputable firms like Equity Trust. Additionally, they offer online account management for convenient access and the flexibility to select from a range of precious metal assets.

Choosing to invest in self-directed IRAs in conjunction with Equity Trust can offer individuals numerous opportunities to diversify their investment portfolios. Through Noble Gold’s online account management system, investors have the ability to easily monitor and oversee their investments from any location.

The flexibility to personally select from a diverse array of precious metals, such as gold, silver, platinum, and palladium, gives investors the autonomy to customize their IRA to align with their financial objectives and risk tolerance.

What Are the Steps to Open an Account with Noble Gold?

The process of opening an account with Noble Gold is straightforward and involves several key steps. Firstly, individuals need to meet the minimum investment requirements set by Noble Gold. Following this, they have the option to select a storage location, with choices including facilities in Delaware or Canada, based on their preferences for secure storage.

Once the minimum investment threshold is determined and the storage location is selected, the next step is to complete the necessary documentation. This paperwork may consist of forms related to account registration, beneficiary designation, and investment preferences. These documents play a crucial role in establishing the account efficiently and ensuring that the precious metal investments are correctly set up.

What Are the Risks Involved in Investing in Noble Gold?

Investing in Noble Gold presents an opportunity for potential returns and portfolio diversification. However, it is crucial to acknowledge the risks involved, including market volatility, regulatory changes, and fluctuations in metal prices, all of which can influence the value of assets and transactions.

Market volatility poses a significant risk as it can lead to abrupt price fluctuations in precious metals, impacting the overall investment value. Additionally, regulatory risks stemming from shifts in government policies or laws can introduce uncertainties into the market environment.

Furthermore, the inherent price volatility in precious metals, driven by factors such as demand dynamics, geopolitical events, and economic indicators, contributes to the unpredictable nature of the market.

To address these risks effectively, investors may explore diversifying their portfolios, staying abreast of market trends, and employing stop-loss orders to mitigate potential losses. Seeking guidance from a financial advisor and conducting thorough research are also valuable strategies for making well-informed investment decisions and navigating the uncertainties inherent in investing in Noble Gold.

What Are the Potential Risks of Investing in Precious Metals?

Investing in precious metals involves various risks, such as insurance coverage, storage fees, and the security of storage facilities. It is essential to evaluate these factors carefully when contemplating investments in precious metals. Investors must be mindful of the potential drawbacks associated with such investments to safeguard their assets effectively.

The scope and extent of insurance coverage for precious metals can differ significantly, necessitating thorough research and a clear understanding of the policy terms. High storage fees can impact the overall investment returns and potentially diminish profits over time. E

nsuring the reliability and security of storage facilities becomes crucial to mitigate risks of theft or loss, underscoring the importance of conducting due diligence when selecting trustworthy storage options.

How Can You Mitigate These Risks?

Reducing investment risks in precious metals involves thorough research, assessing customer feedback, opting for IRS-approved storage solutions, and keeping up-to-date on market trends and regulatory changes to make well-informed choices.

One effective approach is to give precedence to customer reviews when contemplating investments in precious metals. These reviews provide valuable insights into the reputation and dependability of various vendors, allowing investors to evaluate the credibility of potential partners.

Selecting IRS-approved storage facilities ensures that your precious metals are stored securely and in compliance with regulatory requirements.

By staying informed about market developments, investors can respond promptly to shifts and proactively make decisions to effectively manage risks.

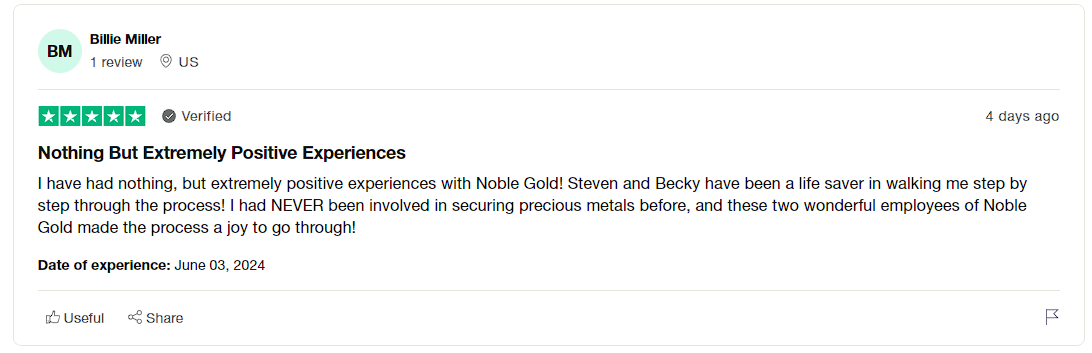

What Do Customers Say About Noble Gold?

Customer feedback on Noble Gold showcases exceptional customer service, competitive pricing, and overall satisfaction with the investment experience, illustrating the company’s dedication to offering value and support to its clients.

Clients have commended Noble Gold for its prompt and knowledgeable customer service representatives, who have navigated them through intricate investment decisions with clarity and patience. Numerous customers have expressed appreciation for the transparent pricing structures, which ensure they feel assured and well-informed during their investment journey.

Testimonials frequently highlight the seamless transactions and personalized attention received, demonstrating Noble Gold’s commitment to fostering long-term relationships and providing a customized experience for each client.

Remember to read our list of the Top Gold Companies to see if Noble Gold Investments made the cut.

Or, if you like what you read about Noble Gold Investments, you can visit their website below.

I’m Bob Smithfield, your guide to making smart, safe investments. Here, I share financial insights and strategies that help you navigate the complex world of finance with confidence.

My goal is to provide you with the information and tools you need to make informed decisions about your finances.